Detection Technology Plc half-yearly report January-June 2019

Detection Technology Plc Company Announcement 2 August 2019 at 9:00 (EEST)

DETECTION TECHNOLOGY PLC HALF-YEARLY REPORT JANUARY-JUNE 2019

Detection Technology Q2 2019: Security sales boosted growth

April-June 2019 highlights

- Net sales increased by 12.8% to EUR 27.5 million (24.4)

- Net sales of Security and Industrial Business Unit (SBU) increased by 27.4% to EUR 19.4 million (15.2)

- Net sales of Medical Business Unit (MBU) decreased by -11.5% to EUR 8.1 million (9.1)

- Operating profit (EBIT) was EUR 4.8 million (5.2)

- Operating margin (EBIT-%) was 17.5% of net sales (21.4%)

January-June 2019 highlights

- Net sales increased by 15.7% to EUR 50.5 million (43.7)

- Net sales of SBU increased by 25.4% to EUR 33.9 million (27.0)

- Net sales of MBU decreased by -0.1% to EUR 16.6 million (16.7)

- Operating profit (EBIT) was EUR 8.7 million (9.0)

- Operating margin (EBIT-%) was 17.1% of net sales (20.5%)

UNAUDITED (Figures in parentheses refer to the corresponding period of the previous year.)

President and CEO, Hannu Martola:

“Security sales for computed tomography (CT) applications boosted our revenue growth to double-digit regardless of some temporary set-backs in our medical business. In the second quarter, SBU sales exceeded our expectations. Then again, MBU sales fell and were disappointing.

Strong demand for CT applications in the luggage-scanning segment continued in China and also increased in other countries. In particular, China’s favorable development and our strong market position increased SBU sales growth to over 27%. In addition, demand for detector solutions for cargo, and especially air cargo, x-ray imaging systems has also escalated in line with e-commerce that is growing at an accelerating rate. In our view, demand for security CT in China, and especially in the rest of the world, will increase in the third quarter, providing a good basis for SBU solution sales.

MBU sales decreased by nearly 12% in the review period. The medical CT market has softened, at least for the rest of the year. The equipment market is expected to grow in the long run, but it will be characterized by fluctuations in demand. Another reason for the negative MBU sales was one of our key customer’s decision to start ramping down production of a solution significant to us earlier than we anticipated before.

Profitability remained at a good level. Although increase in research and development costs and production costs had a negative impact on our profitability from the previous year.

We are updating the company’s strategy until 2025. Our new strategic target is to be a growth leader in digital x-ray imaging detector solutions. We estimate the market size of digital x-ray detectors to be around EUR 3 billion in 2025. Our focus in the 2020 strategy done five years ago was primarily on the CT and line scan x-ray detector and solution markets, which size is estimated to be around EUR 700 million in 2020. Our strategy cornerstones and business model will remain the same. We believe that they support the new growth targets.

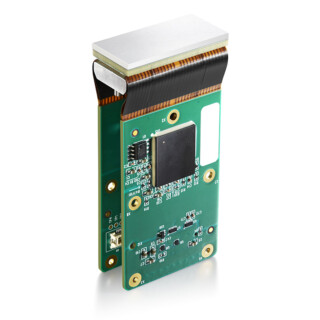

Long-term development projects to improve competitiveness progressed well. The growing interest in the Aurora product family has exceeded our expectations. We are convinced that Aurora will strengthen our competitive position in security x-ray imaging. Aurora volume production is about to begin, and sales of the product family starts at the end of 2019.

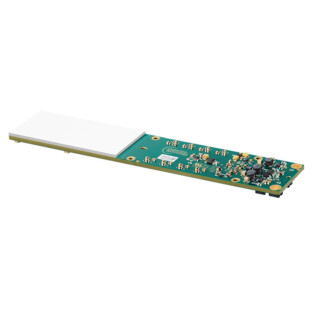

In addition to dental applications, interest in CMOS-based X-Panel x-ray flat panel detectors has also increased in other medical applications. We have started small series production of the X-Panel product family, and customer feedback has been encouraging.

The market has also shown interest in our new multi-energy solutions. Key projects resulting from the MultiX business acquisition and industrialization of multi-energy product solutions have progressed as planned. As we have communicated before, our goal is to launch commercial production of the multi-energy family by the end of next year. We have renamed the MultiX business and product line. We will continue to operate under one unified DT brand. At the same time, we launched the ME abbreviation for the multi-energy product line.

Construction of the second factory in China is proceeding as planned. We have selected the location for the production and service site from the Greater Shanghai area. The new factory will be located in the Huishan industrial cluster in Wuxi city, which is known of high-tech companies and expertise. The cluster is tailored to the needs of the electronics and pharmaceutical industries and provides an excellent ecosystem for our business objectives. The necessary contracts have been made and recruitment has begun. Planning of the factory is in the final stages, and construction of production facilities according to our requirements has begun in the new premises. Production at the new factory will begin in the first quarter of 2020.

Security CT demand continues to be strong in China and will accelerate also in other markets, and we expect SBU sales to increase in the third quarter. In contrast, MBU business is temporarily slowing down for the same reasons that had negative impact on sales in the second quarter. At present, we consider the general geopolitical situation and its direct and indirect effects on our markets to be the greatest risks. In addition, the intensification of the trade war between the superpowers may be detrimental to our business. However, we expect the company’s total revenue to grow double-digit in the third quarter. It is still too early to estimate SBU sales for the rest of the year, but MBU sales are expected to decline from the previous year.

We are strengthening our competitiveness in all of our target markets, and are focusing business development on the key areas defined in our strategy. The medium-term growth and profitability targets remain unchanged.”

Key figures

| (EUR 1,000) | 4-6/2019 | 4-6/2018 | 1-6/2019 | 1-6/2018 | 1-12/2018 | ||||||

| Net sales | 27,473 | 24,350 | 50,525 | 43,669 | 93,916 | ||||||

| Change in net sales, % | 12.8% | 19.5% | 15.7% | 11.3% | 5.5% | ||||||

| Operating profit | 4,804 | 5,213 | 8,659 | 8,954 | 18,522 | ||||||

| Operating margin, % | 17.5% | 21.4% | 17.1% | 20.5% | 19.7% | ||||||

| R&D costs | 2,945 | 2,414 | 5,443 | 4,362 | 8,839 | ||||||

| R&D costs, % of net sales | 10.7% | 9.9% | 10.8% | 10.0% | 9.4% | ||||||

| Cash flow from operating activities | -5,136 | -599 | -88 | 4,606 | 6,122 | ||||||

| Net interest-bearing debt at end of period | -11,332 | -19,294 | -11,332 | -19,294 | -18,290 | ||||||

| Capital expenditure | 700 | 1,261 | 1,407 | 2,221 | 4,741 | ||||||

| Return on investment (ROI), % | 35,9% | 49,9% | 36,4% | ||||||||

| Gearing, % | -21.5% | -43.7% | -21.5% | -43.7% | -35.6% | ||||||

| Earnings per share, EUR | 0.22 | 0.31 | 0.47 | 0.52 | 1.03 | ||||||

| Number of shares at end of period | 14,375,430 | 13,900,595 | 14,375,430 | 13,900,595 | 14,375,430 | ||||||

Business outlook

According to industry estimates, the average long term growth rate of the global medical x-ray imaging market is around 5% per year, 6% in security x-ray equipment market and around 5% in industrial x-ray imaging. However, for the second half of the year, Detection Technology expects a temporary slowdown in medical imaging market growth.

Detection Technology estimates that sales will grow in the SBU business and decrease in the MBU business in the third quarter. The company expects its net sales to increase in the third quarter in line with the company’s financial targets. There is uncertainty regarding demand, and the intensification of competition might be reflected in product prices.

Detection Technology’s medium-term business outlook is unchanged. Detection Technology aims to increase sales by at least 15% per annum and to achieve an operating margin at or above 15% in the medium term.

News conference

A news conference in Finnish is organized for analysts, investors and media on 2 August 2019 at 13:00 EEST at the campus of Aalto University in Otaniemi at the address A Grid, Otakaari 5A, Espoo. The conference is also available as a live webcast. A link to the webcast will be published on the company’s website at www.deetee.com/investors before the event begins. The video of the webcast will be available later on the same web address.

This release is a summary of Detection Technology’s half-yearly report January-June 2019. The complete report is attached to this release as a pdf-file and can also be downloaded from the company’s website.

Detection Technology Plc

Board of Directors

For more information:

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EEST).

Hannu Martola, President and CEO

+358 500 449 475

hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under First North rules.

Detection Technology Plc

Detection Technology is a global provider of x-ray detector solutions for medical, security and industrial applications. The company’s net sales totaled EUR 94 million in 2018. The company has 240 customers in 40 countries. Detection Technology employs over 500 people in Finland, China, France and the US. The company’s shares are listed on the Nasdaq First North Finland marketplace under the ticker symbol DETEC.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

Attachment

Attachments: Detection Technology Plc Half-yearly report January-June 2019 (pdf)