This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

DT as an investment

Foreknow. Foresave.®

We are the most trusted partner imaging the unknown by creating foresight capabilities quicker to discover and prevent threats. Our solutions contribute to the improvement of people’s health and safety daily.

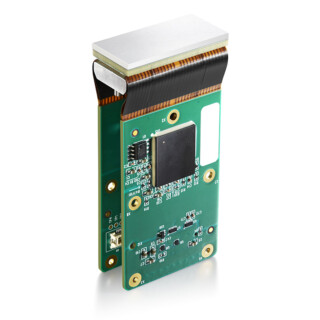

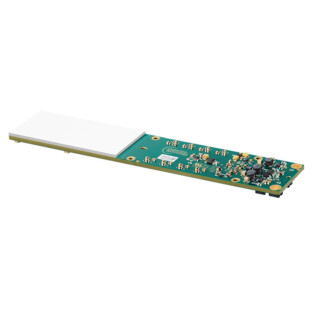

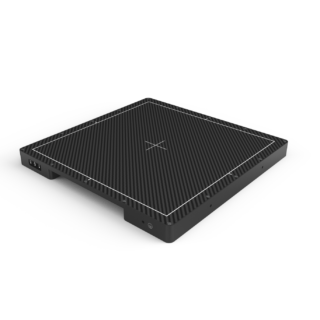

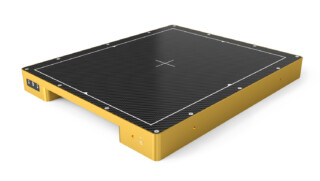

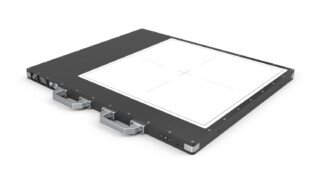

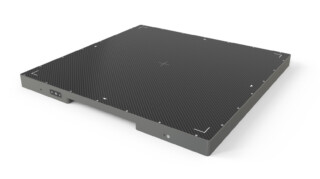

We are a global provider of off-the-shelf and customized X-ray imaging solutions for medical, security and industrial applications. Our product portfolio ranges from photodiodes to complete detector systems with ASICs, electronics, mechanics, software, and algorithms.

Demand for high-quality detector solutions is increasing due to expansion of healthcare to a wider share of population in the emerging economies, aging population, growth in travelling and freight transport, urbanization, increased security concerns and increasing need for X-ray imaging applications in industrial inspection and recycling.

Investment highlights

- Global mega trends driving the growth

- Well-positioned to grow faster than the market

- Strong financial position

- An asset-light business model enabling profitable growth

- The world’s widest linear detector portfolio

- Leader in the CT and line scan X-ray detector markets

- Positioning as a growth leader in digital X-ray detector solutions

Facts and figures

- Established in 1991

- Revenue 104 MEUR in 2023

- EBITA excluding NRI 9% of net sales in 2023

- Around 480 employees in Finland, China, France, and USA

- 460 active customers in over 40 countries

- Headquartered in Espoo, Finland

- Volume production in Beijing and Wuxi, China

- ISO 9001:2015, ISO 14001:2015 and ISO 13485:2016 certified operations

- Implements the Code of Conduct of the Responsible Business Alliance (RBA)

- Listed on Nasdaq First North Growth Market Finland under the ticker symbol DETEC

2025-strategic-target

We aim to be a growth leader in digital X-ray imaging detector solutions and a significant player in other technologies and applications where we see good business opportunities.

Business outlook

Financial statements review January—December 2023

Detection Technology expects its year-on-year total net sales to remain stable in Q1 and H1 of 2024.

Geopolitical situation, U.S.–China relations, global economy, inflation, the high stocks of some of the company’s customers, the indirect impacts of the war in Ukraine, and events in the Middle East create uncertainty.

Detection Technology aims to increase its sales by at least 10% per annum and to achieve an operating margin (EBITA) of 15% in the medium term.

Financial targets

DT has set the following targets with a goal of achieving them during the medium term:

MEDIUM-TERM TARGET

Annual

sales growth

>10%

MEDIUM-TERM TARGET

Operating

margin (EBITA)

15%

ANNUAL

Dividend or

returned capital

30-60%

Market outlook

MEDICAL MARKET

Annual

Growth Rate

5%

SECURITY MARKET

Annual

Growth Rate

6%

INDUSTRIAL MARKET

Annual

Growth Rate

5%

Global trends as growth drivers

Ageing populations

boost investments in healthcare.

The growing importance of security

boosts public and private sector investments in security.

The eco economy

boosts X-ray demand as green products and services, such as energy harvesting and

storing, and electric vehicles, become more common.

The circular economy

boosts X-ray demand as recycling and material sorting increase.

Digitalization and AI

boost X-ray usability as data utilization reaches a new level.

Quality and efficiency requirements

boost the use of X-rays in quality assurance of materials, components, and processes.

Emerging markets

boost investments in healthcare and security as purchasing power increases with GDP growth.

Pandemics

boost healthcare investments in developed and emerging countries.

Lack of raw materials

boosts the use of X-rays in the exploitation of scarce discoveries.

Technology enablers

Accessibility of imaging technology. Accessibility of X-ray imaging equipment and technology affects growth expectations. As volumes increase, the unit cost of equipment decreases, making X-ray imaging equipment an efficient tool to image an increasing number of objects. The decrease in cost subsequently increases the number of uses for the equipment in industrial applications and increases the overall use in medical and security objects.

Reduced radiation dosage. X-ray imaging technologies emit radiation and the current trend is to make dose as low as possible without weakening the quality of the image. Lower dose is also a driver to lower energy use and thus costs; lower dose imaging requires less energy, which accordingly lowers the total cost. Sophisticated and automated X-ray imaging equipment can process images with lower radiation dose.

Digitization of X-ray imaging in emerging markets. Digital X-ray imaging is more efficient as a digital X-ray machine can take more precise and sharper images, more pictures per hour and the cost per picture is lower (lower cost of throughput). Digital images are also immediately available, can be manipulated and the quality of the image may be enhanced, sent via networks to other workstations and can be archived in electronic archives. In addition, digital radiography needs a lower level of radiation than traditional analogue radiography, and no chemicals are needed.

X-rays used to image ever increasing number of objects.