This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

Detection Technology Plc business review January-September 2023

Detection Technology Plc company announcement 27 October 2023 at 09:00 (EEST)

DETECTION TECHNOLOGY PLC BUSINESS REVIEW JANUARY-SEPTEMBER 2023

Detection Technology Q3 2023: Prerequisites for profit improvement in place

July-September 2023 highlights

• Net sales decreased by -10.2% to EUR 24.5 million (27.3)

• Net sales of Industrial Solutions Business Unit (IBU) increased by 1.6% to EUR 4.0 (3.9)

• Net sales of Medical Business Unit (MBU) decreased by -27.0% to EUR 10.8 million (14.8)

• Net sales of Security Business Unit (SBU) increased by 13.7% to EUR 9.7 million (8.5)

• EBITA excluding non-recurring items (NRI) was EUR 2.2 million (0.6)

• EBITA-% excluding NRI was 9.0% of net sales (2.3%)

• EBITA was EUR 1.3 million (0.6)

• EBITA-% was 5.4% of net sales (2.3%)

January-September 2023 highlights

• Net sales increased by 3.0% to EUR 72.5 million (70.4)

• Net sales of IBU decreased by -2.6% to EUR 11.1 (11.4)

• Net sales of MBU decreased by -0.6% to EUR 35.3 million (35.5)

• Net sales of SBU increased by 11.2% to EUR 26.1 million (23.4)

• EBITA excluding non-recurring items (NRI) was 5.0 million (3.3)

• EBITA-% excluding NRI was 6.9% of net sales (4.7%)

• EBITA was EUR 4.2 million (3.0)

• EBITA-% was 5.7% of net sales (4.3%)

UNAUDITED (Figures in parentheses refer to the corresponding period of the previous year.)

President and CEO, Hannu Martola:

“In the big picture, our sales for Q3 were in line with our expectations – medical sales were challenging and growth in the sales of security and industrial applications did not sufficiently compensate for the loss. Our profitability still remained at an unsatisfactory level. We have prioritized business profitability and expect its progressive improvement.

Our industrial application sales increased but lagged behind our expectations. Demand did not yet normalize in a sustainable manner. Sales were negatively impacted by low demand in the food industry, in addition to which some of our key customers continued to clear their stocks. We are cautiously optimistic that the situation will improve toward the end of the year.

The increased uncertainty in the medical market was realized. Demand was soft in all geographical areas and particularly in China, where the ongoing Chinese government anticorruption campaign has adversely impacted healthcare sector market dynamics in short term. However, it is worth noting that a more significant reason for the decrease in sales was the exceptionally strong comparison period in 2022, when sales were postponed from Q2 to Q3 due to a one-off reason. The impact of the anticorruption campaign on demand in China is expected to continue towards next year; however, we expect growth in Q4 in China, too, due to the closing of the yearly budgets in public administration.

The positive trend in the security market continued in particular in the Americas, Europe and India, and our sales experienced double-digit growth. The malaise continued in the Chinese market, but demand is also expected to pick up in China toward the end of the year. Investments in CT equipment in the aviation sector are starting in China and will continue in the U.S.

We have tightened our belts and completed the efficiency measures aimed at improving our profitability right after the end of Q3. We reduced the number of personnel in Finland, China, and France on financial and production-related grounds. We will transfer the small-series production of our photon-counting detector portfolio from France to Finland, to the new premises in Oulu. In addition, we have carried out several other efficiency improvements at the global level.

We will generate total cost savings of about one million euros in H2 of 2023 leading to run-rate savings of ca. two million euros in FY 2024. The cost savings, prior to one-off expenses related to the changes, started to be reflected in our underlying result already at the end of the review period. EBITA for Q3 excluding non-recurring items (NRI) and provisions was around 10%. We expect the result to improve further in Q4. In addition, we improved our operating cash flow, as a result of better working capital management.

We completed the corporate acquisition of Haobo Imaging, and the integration process has progressed as planned. We consolidated the financial information of the business acquisition to Group financial reporting as of the beginning of July. According to our earlier estimate, the net sales of the acquired business are around two million euros in H2 of 2023.

Another strategically important event was the development of the new facilities in Oulu, Finland, which has progressed as planned. The renovation of the premises is already on the way. Both the move and start of production in the new site will take place in early 2024.

Uncertainty will continue to prevail in the medical market, but we expect positive signals to gain ground in our other main markets. The closing of annual budgets in public administration will improve medical sales in Q4. We therefore expect all our businesses to grow in Q4, and we will see high single-digit growth in our total net sales. We also expect the company to grow in Q1 of 2024.”

Key figures

| (EUR 1,000) | 7-9/2023 | 7-9/2022 | 1-9/2023 | 1-9/2022 | 1-12/2022 |

| Net sales | 24,507 | 27,276 | 72,479 | 70,354 | 98,580 |

| Change in net sales, % | -10.2% | 17.5% | 3.0% | 8.1% | 9.8% |

| EBITA excluding NRI | 2,207 | 631 | 5,034 | 3,331 | 6,135 |

| EBITA excluding NRI, % | 9.0% | 2.3% | 6.9% | 4.7% | 6.2% |

| Non-recurring items (NRI) | -873 | 0 | -873 | -335 | -335 |

| EBITA | 1,334 | 631 | 4,161 | 2,997 | 5,801 |

| EBITA, % | 5.4% | 2.3% | 5.7% | 4.3% | 5.9% |

| R&D costs | 2,938 | 3,203 | 8,979 | 9,480 | 12,549 |

| R&D costs, % of net sales | 12.0% | 11.7% | 12.4% | 13.5% | 12.7% |

| Cash flow from operating activities | 3,279 | -496 | 5,598 | -4,024 | 7,121 |

| Net interest-bearing debt at end of period | -10,887 | -17,997 | -10,887 | -17,997 | -20,584 |

| Investments | 11,389 | 166 | 12,217 | 973 | 1,359 |

| Return on investment (ROI), % | 6.9% | 10.9% | 6.9% | 10.9% | 7.5% |

| Gearing, % | -15.5% | -24.7% | -15.5% | -24.7% | -28.3% |

| Earnings per share, EUR | 0.05 | 0.05 | 0.13 | 0.19 | 0.35 |

| Earnings per share (diluted), EUR | 0.05 | 0.05 | 0.13 | 0.19 | 0.35 |

| Number of shares at the end of the period | 14,655,930 | 14,655,930 | 14,655,930 | 14,655,930 | 14,655,930 |

| Weighted average number of shares outstanding | 14,655,930 | 14,655,930 | 14,655,930 | 14,655,930 | 14,655,930 |

| Weighted average number of shares outstanding, diluted | 14,655,930 | 14,655,930 | 14,662,573 | 14,737,413 | 14,717,042 |

The development of net sales

Overall, Detection Technology’s total net sales were in line with expectations in Q3 of 2023. Sales grew in security and industrial applications, but not enough to compensate for the significant decrease in medical sales. The company’s total net sales decreased by -10.2% (17.5%) year-on-year, totaling EUR 24.5 million (27.3).

In the review period, there were no significant changes in the demand drivers and growth in the industrial market. Detection Technology’s sales in industrial solutions grew but fell behind expectations. Demand in the food industry was low, and certain key customers continued to clear the stocks they had accumulated during the component shortage. The net sales of the Industrial Solutions Business Unit (IBU) grew by 1.6% (2.8%) totaling EUR 4.0 (3.9) in Q3 of 2023. IBU generated a total of 16.2% (14.4%) of the company’s net sales.

The net sales of the Medical Business Unit (MBU) decreased by -27.0% (24.0%) year-on-year, totaling EUR 10.8 million (14.8) in Q3 of 2023. On one hand, the decrease in sales is attributed to a new anticorruption campaign in China, focusing in particular on healthcare end-users, that has prolonged their purchase processes. Therefore, demand in medical X-ray imaging solutions softened temporarily. On the other hand, the decrease in sales is mainly explained by the strong comparison period, when the growth was accelerated by sales transferred from the previous quarter due to the component shortage. MBU generated a total of 44.1% (54.3%) of the company’s net sales.

The net sales of the Security Business Unit (SBU) increased by 13.7% (14.6%) year-on-year. The malaise in the Chinese market continued, but demand improved in other geographical areas, in particular in the Americas, Europe and India. Demand continued to recover in all security applications, and particularly in aviation. The increase in SBU sales is attributed to security applications in aviation. SBU’s net sales for Q3 of 2023 were EUR 9.7 million (8.5). SBU generated a total of 39.6% (31.3%) of the company’s net sales.

The Asia-Pacific countries (APAC) accounted for the company’s largest geographical market in Q3 with its 70.4% (80.1%) share. Europe, Middle East, Africa’s (EMEA) share was 20.0% (13.2%) and the Americas’ 9.6% (6.6%). In Q3, Detection Technology’s top five customers accounted for 53.4% (55.2%) of the company’s total net sales.

The company’s total net sales for January-September 2023 increased by 3.0% (8.1%) to EUR 72.5 million (70.4). Net sales of IBU decreased by -2.6% (22.6%) to EUR 11.1 million (11.4). Net sales of MBU decreased by -0.6% (-0.3%) to EUR 35.3 million (35.5). Net sales of SBU increased by 11.2% (16.2%) to EUR 26.1 million (23.4). IBU’s share of total net sales was 15.4% (16.3%), MBU’s 48.7% (50.4%) and SBU’s 36.0% (33.3%).

In January-September 2023, APAC’s share of total net sales was 68.7% (74.1%), EMEA’s 19.7% (18.5%) and the Americas’ 11.6% (7.4%). The share of the five largest customers accounted for 50.5% (51.5%) of total net sales.

Significant events during the review period

On 3 July 2023, Detection Technology announced that it had completed the acquisition of X-ray flat panel detector supplier Shanghai Haobo Imaging Technology Co., Ltd. Detection Technology acquired a total of 89.75% of the shares of Haobo Imaging. The total value of the company’s shares in the acquisition was EUR 13.5 million, 89.75% of which was EUR 12.1 million. The acquisition was financed with cash reserves and a term loan. Apart from ordinary working capital items, no material assets or liabilities were transferred in the acquisition.

The founders and acting management of Haobo Imaging continue to hold 10,25% of the shares. Detection Technology intends to acquire the remaining shares under the terms and conditions agreed by the parties.

The sales of the acquired business are reported as part of Detection Technology’s existing business units, which means that the Group reporting structure has remained unchanged. Detection Technology has consolidated the financial information of the acquired business to the Group’s financial reporting as of the beginning of July 2023.

The net sales of the acquired business are estimated to be around two million euros in H2 of 2023, and its financial result negative. Consolidation will weaken the Group’s profitability (EBITA) by a couple of hundred thousand euros. Consolidation generated a consolidated goodwill of EUR 11.3 million, which will be amortized over its useful life, up to a maximum of ten years. The acquired business is estimated to be EBITA positive in 2025.

Detection Technology initiated measures in Q3 of 2023 to streamline its global operations and improve its profitability. The company decided to centralize its business in eastern China at its production and service site in Wuxi and the new site in Shanghai, which was transferred to the company in the business acquisition. The company therefore closed its talent hub in Nanjing. In addition, the company reduced the number of personnel in its other Chinese units. As a result of these measures, a total of twelve (12) employments were terminated in China.

The company started change negotiations intended in the Finnish Co-operation Act on financial and production-related grounds in Finland in August. The change negotiations were completed on 23 August 2023. As a result of the negotiations, the company terminated nine (9) employments and made changes to job roles.

In September, the company decided to build production capability for photon-counting detector solutions at its new facility under construction in Oulu, Finland, and to transfer small series production from France to Finland. As a result of the production transfer, the company terminated six (6) employments at its French site. The company released the news after the end of the local change process on 6 October 2023.

As a result of the cost saving program, the company entered a total of EUR 0.9 million (0.0) of non-recurring items in Q3. Of these, EUR 0.7 million were attributed to the decrease in the number of personnel and EUR 0.2 million to the reorganization of the operations of the company’s French site.

Detection Technology has also implemented other efficiencies and reorganization measures in the Group sites globally. The measures were completed after the end of the review period. It is estimated that the decreases in the number of personnel and other efficiencies will generate total cost savings of about one million euros in H2 of 2023 and two million euros in FY 2024.

Strategy implementation

Detection Technology completed the acquisition of X-ray flat panel detector supplier Shanghai Haobo Imaging Technology Co., Ltd. The integration process has progressed as planned, and Detection Technology has consolidated the financial information of the acquired business to Group financial reporting as of the beginning of July 2023.

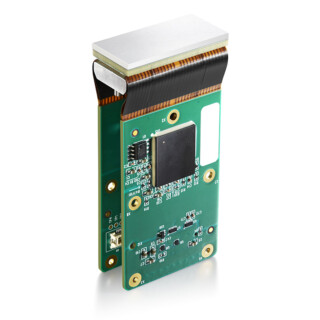

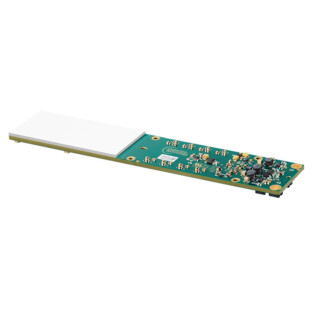

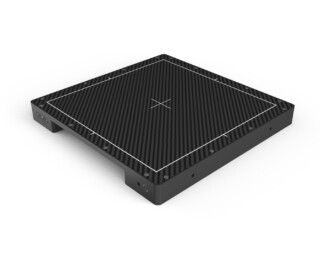

This strategically important corporate acquisition will enhance customer experience and support the company’s long-term growth. It enables Detection Technology to enter the thin-film transistor (TFT) flat panel detector market segment, which is estimated to represent over 40% of the total digital X-ray detector market of EUR 3.1 billion by 2025.

Detection Technology’s product portfolio now covers all digital X-ray imaging detector technologies. The company has commenced the development of new TFT flat panel detector solutions and the introduction of the portfolio to new and existing customers. The products will be commercialized during the next three years.

At the end of 2022, the company announced its plans to expand production in Finland in order to be able to offer a wider range of EU Origin products and to enhance customer experience. In the company’s view, this strategic investment worth about EUR 1.2 million will strengthen the company’s global competitiveness. It is also important in terms of risk management.

The project to expand operations in Oulu, Finland, has progressed as planned in terms of investments and schedule. The renovation to modify the premises to meet the company’s specific needs has started. Both the move and start of production in the new site will take place in Q1 of 2024.

In the review period, Detection Technology decided to build production capability for photon-counting detector solutions at its new facility under construction in Oulu, and to transfer small series production from France to Finland. The company aims to achieve several synergies with these decisions.

The dialogue between product development and production is crucial in the industrialization of new technology. In addition, the new factory in Oulu has been designed and built for demanding electronics manufacturing. Building production capability to Oulu, where Detection Technology already has significant product development, will enhance the company’s learning curve and cost structure.

Detection Technology will continue its long-term investments in the development of the photon-counting detector portfolio, because there is demand in all of the company’s markets: medical, industrial, and security X-ray imaging. Photon-counting technology will play an important role in the future of computed tomography (CT) imaging. Improving material discrimination beyond the level provided by current multi-energy solutions will be important, particularly in medical imaging. In the future, the company will focus especially on strategically important photon-counting computed tomography (PCCT) detector solutions, where the commercial potential is the greatest.

Business outlook

Detection Technology expects its total net sales to grow in Q4 of 2023 and in Q1 of 2024.

Geopolitical situation, U.S.–China relations, global economy, inflation, the high stocks of some of the company’s customers, the indirect impacts of the war in Ukraine, and recent events in the Middle East create uncertainty.

Detection Technology aims to increase its sales by at least 10% per annum and to achieve an operating margin (EBITA) of 15% in the medium term.

Financial statements review 2023

Detection Technology will publish its financial statements review for 2023 on Thursday, 1 February 2024.

Espoo 26 October 2023

Board of Directors

Detection Technology Plc

Further information

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EEST).

Hannu Martola, President and CEO

+358 500 449 475, hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under the Nasdaq First North GM rules.

Detection Technology is a global provider of X-ray detector solutions and services for medical, security, and industrial applications. The company’s solutions range from sensor components to optimized detector subsystems with ASICs, electronics, mechanics, software, and algorithms. It has sites in Finland, China, France, and the US. The company’s shares are listed on Nasdaq First North Growth Market Finland under the ticker symbol DETEC.

Distribution: Nasdaq Helsinki, key media, www.deetee.com

Attachments: Detection Technology Plc business review January-September 2023 (pdf)