This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

Detection Technology Plc business review January–September 2021

Detection Technology Plc company announcement 27 October 2021 at 09:00 (EEST)

DETECTION TECHNOLOGY PLC BUSINESS REVIEW JANUARY–SEPTEMBER 2021

Detection Technology Q3 2021: Growth in all three business units

July–September 2021 highlights

• Net sales increased by 12.5% to EUR 23.2 million (20.6)

• Net sales of Industrial Solutions Business Unit (IBU) increased by 21.5% to EUR 3.8 million (3.1)

• Net sales of Medical Business Unit (MBU) increased by 18.8% to EUR 11.9 million (10.1)

• Net sales of Security Business Unit (SBU) increased by 0.2% to EUR 7.5 million (7.4)

• Operating profit (EBIT) excluding non-recurring items (NRI) was EUR 3.3 million (2.8)

• Operating margin (EBIT-%) excluding NRI was 14.1% of net sales (13.4%)

• Operating profit (EBIT) was EUR 3.3 million (2.6)

• Operating margin (EBIT-%) was 14.1% of net sales (12.6%)

January–September 2021 highlights

• Net sales increased by 5.5% to EUR 65.1 million (61.7)

• Net sales of IBU increased by 6.4% to EUR 9.3 (8.8)

• Net sales of MBU increased by 25.7% to EUR 35.6 million (28.3)

• Net sales of SBU decreased by -18.0% to EUR 20.2 million (24.6)

• Operating profit (EBIT) excluding non-recurring items (NRI) was EUR 7.6 million (6.5)

• Operating margin (EBIT-%) excluding NRI was 11.7% (10.6%)

• Operating profit (EBIT) was EUR 7.6 million (6.4)

• Operating margin (EBIT-%) was 11.7% of net sales (10.3%)

UNAUDITED (Figures in parentheses refer to the corresponding period of the previous year.)

Key figures

| (EUR 1,000) | 7-9/2021 | 7-9/2020 | 1-9/2021 | 1-9/2020 | 1-12/2020 |

| Net sales | 23,210 | 20,628 | 65,066 | 61,653 | 81,561 |

| Change in net sales, % | 12.5% | -23.4% | 5.5% | -20.4% | -20.4% |

| Operating profit excluding non-recurring items (NRI) | 3,282 | 2,758 | 7,618 | 6,528 | 8,877 |

| Operating margin excluding NRI, % | 14.1% | 13.4% | 11.7% | 10.6% | 10.9% |

| Non-recurring items (NRI) | 0 | 163 | 0 | 163 | 163 |

| Operating profit | 3,282 | 2,595 | 7,618 | 6,365 | 8,714 |

| Operating margin, % | 14.1% | 12.6% | 11.7% | 10.3% | 10.7% |

| R&D costs | 2,589 | 2,282 | 7,557 | 7,588 | 9,827 |

| R&D costs, % of net sales | 11.2% | 11.1% | 11.6% | 12.3% | 12.0% |

| Cash flow from operating activities | 783 | 2,052 | 4,659 | 4,221 | 7,522 |

| Net interest-bearing debt at end of period | -23,261 | -17,557 | -23,261 | -17,557 | -19,364 |

| Investments | 457 | 578 | 1,110 | 1,587 | 3,081 |

| Gearing, % | -34.4% | -31.0% | -34.4% | -31.0% | -33.1% |

| Earnings per share, EUR | 0.20 | 0.12 | 0.44 | 0.30 | 0.47 |

| Number of shares at the end of the period | 14,578,430 | 14,375,430 | 14,578,430 | 14,375,430 | 14,375,430 |

President and CEO, Hannu Martola:

“All our businesses grew in Q3. Demand was good both in medical and industrial solutions and our sales saw double-digit growth. The dawning upward turn that was seen in the demand for security applications at the end of Q2 gained strength, our sales grew slightly and we expect better growth in the future. This strengthened our view that all our businesses will see double-digit growth in H2 of 2021, and the growth of our total net sales will speed up despite the fact that the material and component shortage slows down this anticipated growth. However, the global delivery restriction remains a risk.

Investments in healthcare infrastructure globally and particularly in China as well as demand in higher-end computed tomography (CT) equipment continued, and our MBU sales experienced double-digit growth. Sales were, however, somewhat lower than we expected, because some of our clients postponed our deliveries as they were unable to acquire the other materials they needed for their equipment in time. Medical market drivers have remained unchanged, and we are in a good position in the CT-driven growth market. Therefore, in our opinion, strong development in MBU will continue well into 2022.

IBU saw record sales in Q3 of 2021. Demand in all main applications in the industrial market was better than expected, and our ability to deliver was better than that of our competitors. Thanks to our customer focus and good flexibility of our supply chain we were able to win new strategic customers and projects in Q3. We believe this trend will continue.

The security market has continued to normalize on all fronts, as demand is increasing also in the aviation segment. Our ability to deliver was slightly better than that of our competitors also in the security segment, but some sales were postponed due to the lack of special materials. We were glad to see that despite challenges in the availability of materials, our SBU sales were ultimately positive and that the market has taken an upward turn towards growth. We consider double-digit growth in security application sales in H2 a realistic goal.

Our profitability improved from H1, and expected sales growth in H2 will help create a positive financial result. In this respect as well it seems, that we are in line with our targets in Q4.

The implementation of the DT-2025 strategy has progressed as planned. In Q3, we focused in particular on speeding up our product development cycle, implementing production processes that bring added value in our Wuxi production and service unit, and rolling out development programs in leadership and corporate culture. It is also worth noting that our new products launched in Q2 have been warmly welcomed by the target markets, and Aurora XS sales have started.

Our business outlook for the end of this year and the beginning of the next is strong, and we expect all our businesses to see double-digit growth both in Q4 of 2021 and H1 of 2022. The double-digit growth in MBU and IBU sales will be stronger in Q4 than in Q3 of 2021, and SBU sales will reach the double-digit growth path.

Although demand has taken an upward turn in all our markets and our outlook is positive, our business still faces some uncertainty. The global shortage of components has had indirect and direct impacts on the outcome of Q3 of 2021, and the risks related to the availability of special materials and electronic components have increased. Challenges in availability and longer delivery times have an impact on our ability to meet the growing demand. We have intensified our measures to mitigate risks and will keep our medium-term growth and profitability targets unchanged.”

Sales development

Demand in both medical and industrial applications in Q3 was strong, and the growth in the demand of security applications started at the end of Q2 has gained strength. As a result, the sales of all Detection Technology’s business units grew, and the company’s total net sales were EUR 23.2 million (20.6). Net sales grew by 12.5% (-23.4%) year-on-year.

In the industrial market, demand was strong in all of the company’s main segments: imaging solutions for the food, pharmaceutical, and mining industries. The net sales of the Industrial Solutions Business Unit (IBU) grew by 21.5%, totaling EUR 3.8 (3.1). IBU generated a total of 16.4% (15.2%) of the company’s net sales.

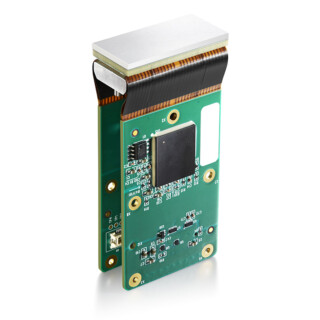

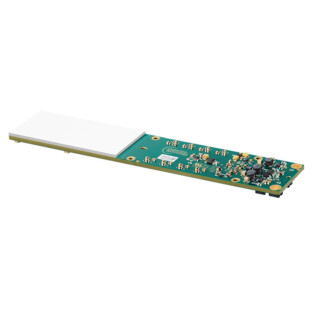

The growth drivers of the medical X-ray imaging market remained unchanged compared to H1. Investments in healthcare infrastructure globally and particularly in China as well as demand for higher-end computed tomography (CT) equipment continued and, as a result, sales growth of the Medical Business Unit (MBU) was mainly generated by next-generation CT products. The company expects X-Panel sales to commence. MBU’s net sales grew by 18.8% year-on-year, totaling EUR 11.9 million (10.1). MBU generated a total of 51.5% (48.7%) of the company’s net sales.

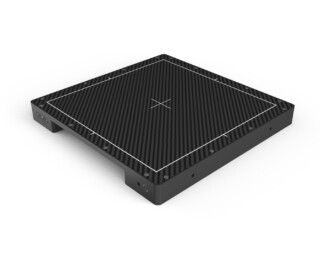

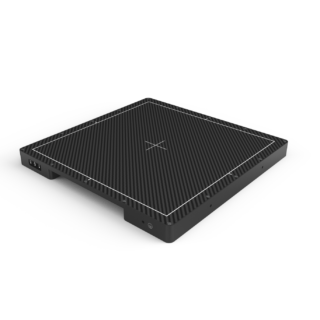

In the security market, the normalization of demand has started in all segments, and demand has taken an upward turn also in the aviation sector. Projects to standardize imaging solutions used in the aviation continued again on various continents, and investments in airports are gaining strength, particularly in the United States. This has resulted in an increasing demand in CT detectors for the security segment, which will boost the growth in sales next year. The company considers its position in the security CT segment to be strong. Delivery challenges attributed to the availability of components affected the security applications market, and some of the company’s sales were postponed for the same reason. The net sales of the Security Business Unit (SBU) increased by 0.2% year-on-year, totaling EUR 7.5 million (7.4). SBU generated a total of 32.1% (36.1%) of the company’s net sales.

The Asia-Pacific countries (APAC) accounted for the company’s largest geographical market area in Q3 of 2021, with its 74.2% (66.2%) share. The share of Europe, the Middle East, and Africa (EMEA) was 20.8% (26.3%), and the Americas 5.0% (7.5%). The share of net sales accounted for by Detection Technology’s top five customers was 55.8% (52.9%).

The company’s total net sales in January–September 2021 grew by 5.5% to EUR 65.1 million (61.7). MBU’s net sales grew by 25.7% totaling EUR 35.6 million (28.3). The net sales of SBU decreased by -18.0% to EUR 20.2 million (24.6). IBU’s net sales grew by 6.4% totaling EUR 9.3 million (8.8). MBU generated a total of 54.7 % (45.9 %) of the company’s net sales, SBU a total of 31.0 % (39.9 %), and IBU a total of 14.3 % (14.2 %).

APAC’s share of total net sales was 72.6% (66.1%), that of EMEA 19.1% (22.6%), and that of the Americas 8.3% (11.3%) in the review period January–September 2021. Top five customers accounted for 54.1% (53.2%) of the company’s total net sales.

Strategy

Detection Technology has continued to roll out its DT-2025 strategy and develop its business in order to enhance its competitiveness. The new products launched by the company in Q2 have received a positive welcome in the target markets, and Aurora XS sales started in Q3.

In Q3, Detection Technology invested in particular in speeding up the product development cycle and implementing production processes that bring added value to the Wuxi production and service unit in the Greater Shanghai area. In addition, the company rolled out global development programs in leadership and corporate culture and continued working in line with its sustainability agenda at both the local and Group levels.

Business outlook

According to Detection Technology’s view, the medical and industrial markets will grow in line with the pre-pandemic estimates by the experts, on average about 5% per year. The market disturbance caused by the pandemic is passing in the security market, as demand has taken an upward turn also in the aviation segment, but the normalization of growth to the pre-pandemic level of 6% will be slow.

According to Detection Technology’s view, demand will continue to be strong both in the medical and industrial imaging applications, and the double-digit growth of the Medical and Industrial Solutions business units will be greater in Q4 than in Q3 of 2021. The demand in security applications will improve, and the company expects the Security Business Unit to have double-digit growth in net sales in Q4 of 2021. Detection Technology expects double-digit growth in its total net sales also in H1 2022.

Due to the pandemic, global economy and the company’s business have faced exceptional and temporary uncertainty. Predictability of the company’s target markets is still lower than usual, and risks related to the availability of materials have increased. The effect of material and component shortage has been acknowledged as a limiting factor in the outlook, however a further degradation in supply chain might affect the business outlook.

Detection Technology aims to increase sales by at least 10% per annum and to achieve an operating margin at or above 15% in the medium term.

Financial statements review 2021

Detection Technology will publish its financial statements review for 2021 on Wednesday 2 February 2022.

Espoo, Finland 26 October 2021

Board of Directors, Detection Technology Plc

Further information

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EEST).

Hannu Martola, President and CEO

+358 500 449 475, hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under the Nasdaq First North GM rules.

Detection Technology is a global provider of X-ray detector solutions for medical, security, and industrial applications. The company’s solutions range from photodiodes to optimized detector subsystems with ASICs, electronics, mechanics, software, and algorithms. The company has sites in Finland, China, France, and the US. The company’s shares are listed on Nasdaq First North Growth Market Finland under the ticker symbol DETEC.

Distribution: Nasdaq Helsinki, key media, www.deetee.com

Attachments: Detection Technology Plc business review January-September 2021 (pdf)