Detection Technology Plc business review January-September 2018

Detection Technology Plc Company Announcement 24 October 2018 at 9:00 (EEST)

DETECTION TECHNOLOGY PLC BUSINESS REVIEW JANUARY-SEPTEMBER 2018

Detection Technology Q3: Good result, medical applications spurred growth

July-September 2018 highlights

-

Net sales increased by 10.6% to EUR 24.6 million (22.2)

-

Net sales of Security and Industrial Business Unit (SBU) decreased by -2.2% to EUR 13.0 million (13.3)

-

Net sales of Medical Business Unit (MBU) increased by 29.8% to EUR 11.5 million (8.9)

-

Operating profit (EBIT) was EUR 5.2 million (5.1)

-

Operating margin (EBIT-%) was 21.0% of net sales (22.9%)

January-September 2018 highlights

-

Net sales increased by 11.0% to EUR 68.3 million (61.5)

-

Net sales of Security and Industrial Business Unit (SBU) increased by 4.0% to EUR 40.1 million (38.5)

-

Net sales of Medical Business Unit (MBU) increased by 22.8% to EUR 28.2 million (23.0)

-

Operating profit (EBIT) was EUR 14.1 million (12.9)

-

Operating margin (EBIT-%) was 20.7% of net sales (21.0%)

(Figures in brackets refer to the corresponding period of the previous year.)

Key figures

| (EUR 1,000) | 7-9/2018 | 7-9/2017 | 1-9/2018 | 1-9/2017 | 1-12/2017 |

| Net sales | 24,596 | 22,234 | 68,264 | 61,473 | 89,003 |

| Change in net sales, % | 10.6% | 16.1% | 11.0% | 18.3% | 17.9% |

| Operating profit | 5,161 | 5,084 | 14,115 | 12,905 | 19,892 |

| Operating margin, % | 21.0% | 22.9% | 20.7% | 21.0% | 22.3% |

| R&D costs | 2,083 | 1,977 | 6,445 | 5,362 | 7,157 |

| R&D costs, % of net sales | 8.5% | 8.9% | 9.4% | 8.7% | 8.0% |

| Cash flow from operating activities | 1,152 | 5,378 | 5,758 | 10,869 | 18,625 |

| Net interest-bearing debt at end of period | -19,072 | -15,166 | -19,072 | -15,166 | -21,774 |

| Capital expenditure | 1,374 | 0 | 3,595 | 1,145 | 1,833 |

| Gearing, % | -39.8% | -41.8% | -39.8% | -41.8% | -52.3% |

| Earnings per share, EUR | 0.32 | 0.29 | 0.84 | 0.74 | 1.09 |

| Number of shares at end of period | 13,900,595 | 13,425,775 | 13,900,595 | 13,425,775 | 13,900,595 |

President and CEO, Hannu Martola:

“We achieved a good result in the third quarter. Operating profit was EUR 5.2 million, which corresponds to 21% of net sales. During the third quarter, sales growth leveled off as the good second-quarter demand in security applications decelerated. Our net sales grew around 11% from the corresponding period, and totaled EUR 24.6 million.

The strong sales growth continued in MBU business, but SBU sales declined from the corresponding period. Net sales of MBU increased by 30% due to good demand in Asia. SBU sales declined by -2% because of the slowdown in China’s security market and tightening of the competitive environment. We estimate that growth in the Chinese security market has now normalized after a period of exceptional growth.

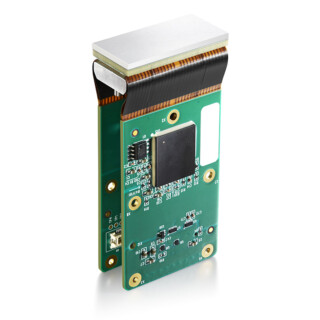

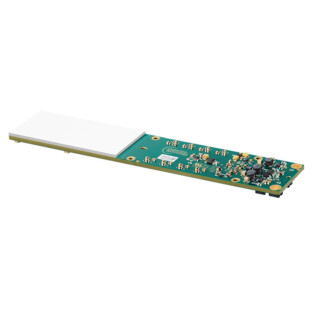

We made a major product release in September, when we introduced the fully digital Aurora X-ray detector family. The product family has the highest level of integration and the simplest structure, which enhances the performance and mechanical durability of imaging systems, minimizes risks and streamlines the supply chain. Aurora will replace both our analog and first generation digital product families. The new product family has been well received in the security segment, and it improves our competitiveness. Sales of the Aurora product family will have an impact on SBU revenue at the end of next year.

We expect sales to grow in the MBU business during the last quarter, and a continued decline in SBU sales. In our view, China’s security market will not increase towards the end of the year, as many infrastructure projects have been suspended due to the indirect consequences of protectionist trade policies. It appears that the X-ray imaging market will grow in 2019 at the same pace as this year, and we expect the company’s sales to grow moderately at the beginning of 2019. The medium-term growth targets remain unchanged.”

Markets

According to industry estimates, the average growth rate of the medical X-ray imaging market is around 5% per year, 7% in the security X-ray equipment market and around 5% in industrial X-ray imaging. During the third quarter, Detection Technology’s net sales increased by 10.6% (16.1%) to EUR 24.6 million (22.2). The operating profit amounted to EUR 5.2 million (5.1), corresponding to 21.0% of net sales (22.9%).

Net sales of Detection Technology’s Medical Business Unit (MBU) grew 29.8% (74.8%) from the corresponding period, and were EUR 11.5 million (8.9) in the third quarter. The growth in MBU net sales was due to continued good demand for volume products and successful customer shipments. MBU’s share of total net sales was 47.0% (40.0%).

Net sales of the Security and Industrial Business Unit (SBU) decreased by -2.2% (-5.2%) compared to the same period last year, because of the slowdown in the China market and tightening price competition. Third quarter net sales of SBU totaled EUR 13.0 million (13.3). SBU’s share of total net sales was 53.0 % (60.0 %).

In the review period July-September 2018, Asia was the biggest market with a 64.8% (60.9%) share. Americas was the second-largest market, and its share of total net sales was 18.9% (29.1%). Europe’s share increased and was 16.3% (10.0%). The top five customers accounted for 60.2% (62.0%) of net sales.

In January-September 2018, the company’s net sales grew by 11.0% to EUR 68.3 million (61.5). Operating profit was EUR 14.1 million (12.9), which corresponds to 20.7% of net sales (21.0%). Net sales of MBU grew 22.8% to EUR 28.2 million (23.0). Net sales of SBU were EUR 40.1 million (38.5), which is 4.0% more than in the corresponding period. MBU’s share of total net sales was 41.3 % (37.4 %), and SBU’s 58.7 % (62.6 %).

In the review period January-September 2018, Asia’s share of total net sales was 61.7% (58.3%), the Americas’ 19.0% (27.7%) and Europe’s 19.3% (14.0%). The top five customers accounted for 56.1% (55.6%) of net sales.

Strategy

In September, Detection Technology introduced a digital X-ray detector product family, called Aurora, to the security and industrial markets. The product family consists of a wide range of detector boards and modules, readout electronics, and all the necessary accessories for end-to-end X-ray imaging systems. The company has designed and industrialized an application-specific integrated circuit (ASIC) and significantly simplified the product structure for this product family. This enables faster go to market for performance-enhancing and mechanically more robust imaging solutions.

Detection Technology has proceeded as planned in the renewal of its enterprise resource planning (ERP) system, and has decided to deploy the new system by the end of the year. During the review period, the company completed the product data management (PDM) system deployment project. In addition, the company continued to make significant investments in R&D projects and gaining new customers.

Business outlook

Detection Technology expects the fourth quarter sales to grow in medical applications, but predicts a decline in sales for the security and industrial markets. There is still uncertainty in demand. According the company estimate, the X-ray imaging market will grow in 2019 at the same pace as this year, and under the circumstances, Detection Technology believes that the company’s sales will grow moderately at the beginning of year 2019.

Detection Technology’s mid-term business outlook remains unchanged. The company aims to increase sales by at least 15% per annum and to achieve an operating margin at or above 15% during the medium term.

Financial statements review 2018

Detection Technology will publish its financial statements review for 2018 on 1 February 2019.

Detection Technology Plc

Board of Directors

For more information:

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EEST).

Hannu Martola, President and CEO

+358 500 449 475

hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under First North rules.

Detection Technology Plc

Detection Technology is a global provider of X-ray detector solutions for medical, security and industrial applications. The company’s net sales grew 18% to EUR 89 million in 2017. The company has 240 customers in 40 countries. Detection Technology employs over 450 people in Finland, China and the US. The company’s shares are listed on the Nasdaq First North Finland marketplace under the ticker symbol DETEC.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

Attachments: Detection Technology Plc Business Review January-September 2018 (pdf)