This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

Detection Technology Oy, one of the leading X-ray detector providers, is reviewing preconditions for an initial public offering on First North Finland market place

Not for publication or distribution, directly or indirectly, in or into the United States, Canada, Australia, New Zealand, Hong Kong, South Africa, Singapore or Japan or any other jurisdiction in which the distribution or release would be unlawful.

DETECTION TECHNOLOGY OY, ONE OF THE LEADING X-RAY DETECTOR PROVIDERS, IS REVIEWING PRECONDITIONS FOR AN INITIAL PUBLIC OFFERING ON FIRST NORTH FINLAND MARKET PLACE

Detection Technology Oy (“Detection Technology” or the “Company”), one of the leading X-Ray detector providers, is reviewing preconditions for an initial public offering (IPO) on First North Finland marketplace maintained by NASDAQ OMX Helsinki Ltd.

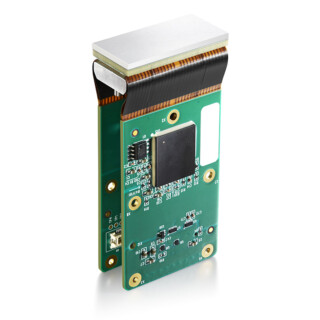

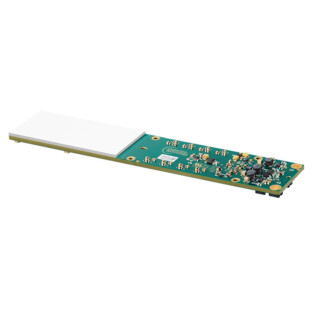

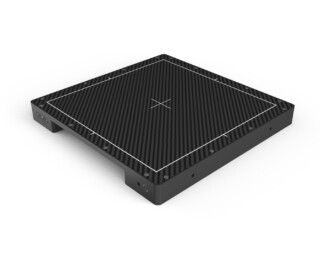

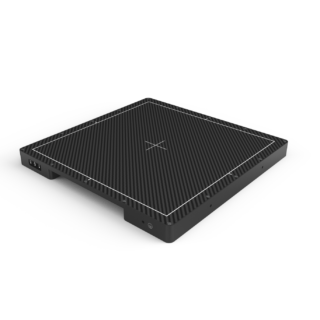

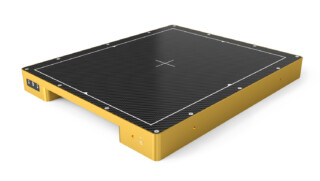

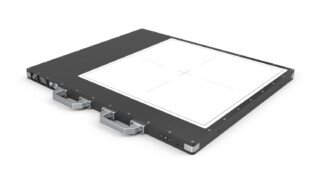

Detection Technology develops, produces, markets and sells components and systems for X-ray imaging solutions. The Company’s products include X-ray imaging components and systems for medical, security and industrial X-ray imaging applications.

Detection Technology has grown strongly in the past years. Between 2009 and 2014 Detection Technology’s compound annual growth has exceeded 30%. In 2014, annual net sales of the Company were EUR 33 million of which Asia-Pacific accounted for 54%, and Americas and Europe 23% each. The objective of a potential IPO is to raise some EUR 20 million of new capital to support growth and development of the Company’s business operations. In connection with the contemplated IPO, the existing shareholders of the Company would agree to sell part of their holdings in order to guarantee the liquidity of the shares.

“Detection Technology’s business operations began in the early 1990’s and today we have excellent client relationships and broad technology competence in imaging solutions and one of the widest X-ray detector product portfolios in the industry. Our internationalization and growth has been strong during the past years and we are now one of the key players in components and systems for X-ray imaging solutions. We believe that the demand in our end markets is supported by trends such as the increased investments into healthcare and security in emerging markets, rising concern towards insecurity, as well as aging population to name a few. The contemplated IPO would support our strong growth intentions and further enhance our potential to expand globally” says CEO Hannu Martola.

The major shareholder of Detection Technology is Oy G.W.Sohlberg Ab, holding 71% of the shares of the Company.

Nordea Bank Finland Plc is acting as the advisor of the Company and it would act as the lead manager of the contemplated IPO. Attorneys at law Borenius Ltd acts as the legal advisor of the Company.

DETECTION TECHNOLOGY OY

Hannu Martola

President and CEO

Further information:

Detection Technology Oy

Hannu Martola, toimitusjohtaja

+358 500 449475

hannu.martola@nulldeetee.com

Andreas Tallberg, hallituksen puheenjohtaja

+358 40 700 2252

andreas.tallberg@nullgws.fi

Detection Technology in brief

Detection Technology (DT) is a supplier of X-ray imaging and detection solutions for leading equipment manufacturers in the medical, security and industrial markets. Detection Technology develops and produces photodiodes, ASICs, electronics, mechanics and software through its research and development centers and manufacturing facilities located in Finland and China.

The Company’s technology-driven products are the result of long-term cooperation with customers, combined with a deep understanding of solid-state X-ray imaging technology and markets.

Detection Technology has two business units, the medical business unit (MBU) and the security and industrial business unit (SBU).

For medical applications, DT provides customized solutions for computed tomography, mammography, bone densitometry, and chest and trauma X-ray. The Company’s product portfolio ranges from photodiodes to complete imaging systems. In 2014, approximately 38 per cent of DT’s net sales derived from the medical business.

Security solutions are used for passenger, baggage and cargo inspections in airports and customs. DT provides off-the-shelf detector products and customized systems for security screening applications. Industrial solutions are used to improve efficiency and reduce cost in several industries such as the food and pharmaceutical industry, forest industry, automotive, renewable energy, oil and gas as well as mining and agriculture. DT provides off-the-shelf detector products for X-ray quality assurance, sorting and non-destructive testing applications. Products range from detector cards to complete detector systems. In 2014, the security and industrial business represents approximately 62 per cent of DT’s total net sales.

In 2014, DT’s net sales totaled EUR 33 million and operating margin was 9% (the comparable operating margin being 12%). The Company has approximately 280 employees. The Company operates from offices and production facilities in Espoo and Oulu, Finland, Beijing, China, Hong Kong and Boston, United States.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

DISCLAIMER:

The information contained in this company release shall not constitute an offer to sell or the solicitation of an offer to buy the securities referred to herein. Any potential decision to invest in the securities mentioned herein, either through subscription or purchase, shall be exclusively based on the prospectus published in connection with such offer, and not on this stock exchange release.

The information contained herein is not for publication or distribution, directly or indirectly, in or into the United States, Canada, Australia, New Zeeland, South Africa, Hong Kong, Singapore or Japan or any other jurisdiction in which according to applicable legislation the distribution or release would be unlawful. This release does not constitute an offer of securities for sale in the United States, nor may the securities be offered or sold in the United States absent registration or an exemption from registration as provided in the U.S. Securities Act of 1933, as amended, and the rules and regulations thereunder. The Company does not intend to register any portion of the possible offering in the United States or to conduct a public offering of securities in the United States.