This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

DETECTION TECHNOLOGY PLC’S FINANCIAL STATEMENTS REVIEW JANUARY-DECEMBER 2015

Detection Technology Plc Company Announcement February 2, 2016 at 09.00 (CET +1)

DETECTION TECHNOLOGY PLC’S FINANCIAL STATEMENTS REVIEW JANUARY-DECEMBER 2015

Detection Technology reports strong net sales and profit growth

Fourth quarter 2015 highlights

-

Net sales increased by 56.4% to EUR 15.21 million (9.73)

-

Net sales of Security and Industrial Business Unit (SBU) grew 68.7% and Medical Business Unit (MBU) 37.0%

-

Operating profit (EBIT) excluding non-recurring items (NRI) was EUR 2.43 million (1.08)

-

Operating profit margin (EBIT-%) excluding NRI was 16.0% of net sales (11.2%)

-

NRI related to DT’s new factory was EUR -0.69 million

-

R&D costs totaled EUR 1.36 million (1.18), 8.9% of net sales (12.1%)

-

Strong and escalating demand from the security imaging market

-

Fast ramp up of the new factory enabled high sales volume

Full-year 2015 highlights

-

Net sales increased by 29.2% to EUR 42.78 million (33.11)

-

Net sales of SBU grew 31.0% and MBU 26.4%

-

Operating profit (EBIT) excluding NRI amounted to EUR 4.54 million (4.13)

-

Operating profit margin (EBIT-%) excluding NRI was 10.6% of net sales (12.5%)

-

NRI relating to DT’s new factory amounted to EUR -1.10 million

-

R&D costs totaled EUR 5.70 million (4.12), 13.3% of net sales (12.4%)

-

Capital expenditure was EUR 4.77 million (1.28)

-

DT was listed on the NASDAQ First North Finland market place on March 16, 2015

President and CEO, Hannu Martola:

“Our fourth quarter results were strong. Net sales grew 56.4%, and operating profit totaled 2.43 million euros. The positive growth in sales and production volumes for old and new customers in both of our business units led to exceptional growth. The strong market demand in the Security and Industrial Business Unit (SBU) was mainly driven by increasing security concerns. The growth in our Medical Business Unit (MBU) was an outcome of rising volumes in our newer projects.

Net sales of the SBU grew 68.7 % in the last quarter. We were well positioned to meet the demand through our wide product portfolio and strong presence in Asia. However, high quarterly volatility is typical for our business. The last quarter’s sales were a significant achievement, and it will be challenging for us to improve this in 2016.

The production was ramped up faster than expected in our new Beijing factory and enabled us the high delivery output. As the factory is now up and running, the investment is fully supporting our strategic targets.

What comes to the other cornerstones of our strategy, we have strengthened our position in US and broadened the technology and customer bases. Costs related to these had an impact on our profitability, but will support our annual growth target in a mid-term period.”

Key figures

| (EUR 1 000) | Q4 2015 | Q4 2014 | Change % | 2015 | 2014 | Change % |

| Net sales | 15 212 | 9 725 | 56.42% | 42 782 | 33 112 | 29.2% |

| Net sales growth % | 56.4% | 10.7% | 29.2% | 9.2% | ||

| Operating profit (EBIT) excl. NRI* | 2 433 | 1 084 | 124.3% | 4 534 | 4 127 | 9.9% |

| Operating profit (EBIT) % excl. NRI | 16.0% | 11.2% | 10.6% | 12.5% | ||

| Non-recurring items (NRI) ** | 688 | 398 | 1 098 | 1 048 | ||

| Operating profit | 1 741 | 686 | 153.6% | 3 437 | 3 079 | 11.6% |

| Operating profit margin % | 11.44% | 7.1% | 8.0% | 9.3% | ||

| R&D costs | 1 357 | 1 178 | 15.2% | 5 696 | 4 121 | 38.2% |

| R&D costs, % of net sales | 8.9% | 12.1% | 13.3% | 12.4% | ||

| Cash flow from operating activities | 5 355 | 2 090 | 156.2% | 2 622 | 3 085 | -15.0% |

| Net interest bearing debt at end of period | -5 444 | 8 678 | -162.7% | -5 444 | 8 678 | -162.7% |

| Capital expenditure | 3 450 | 1 133 | 204.5% | 4 770 | 1 280 | 272.7% |

| Gearing, % | -25.8% | 654.0% | -25.8% | 654.0% | ||

| Earnings per share, EUR | 0.10 | 0.31 | -67.2% | 0.07 | 1.45 | -95.1% |

| Earnings per share diluted, EUR*** | 0.10 | 0.05 | 123.6% | 0.07 | 0.21 | -66.3% |

| Number of shares at the end of the period | 12 950 975 | 1 900 195 | 12 950 975 | 1 900 195 |

*As of 2015 DT has made a change in the treatment of potential future warranty costs and makes a provision of 1.5% of net sales. The warranty provision affects the January-December 2015 operating profit by EUR 0.60 million.

** In Q4/2014 DT recognized EUR 0.4 million of non-recurring quality and NPI costs. In 2014, DT recognized EUR 1.0 million of non-recurring quality and NPI costs.

***The earnings per share information for 2014 figures was computed as if the shares issued in conjunction with the IPO had been outstanding for the entire comparison period.

Business outlook for 2016

Detection Technology’s sales outlook is in accordance with its medium term target to increase sales by at least 15% per annum. DT forecasts its profitability to develop in accordance with its medium term target of operating margin at or above 15%. R&D costs as a percentage of net sales in 2016 are expected to be lower than in 2015. The outlook is based on the current market activity and the company’s position in the market.

This release is a summary of Detection Technology’s financial statements review January-September 2015. The complete financial statements review is attached to this release as a pdf-file and can also be found on the company’s website www.deetee.com/investors/financial-information.html

Detection Technology Plc

Board of Directors

For more information:

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9-11 a.m. (CET+1).

Hannu Martola, President and CEO

+358 500 449 475

hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under First North rules.

Detection Technology Plc

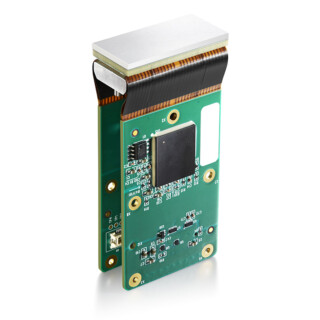

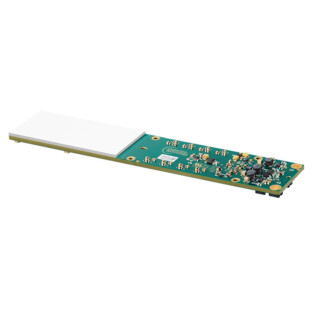

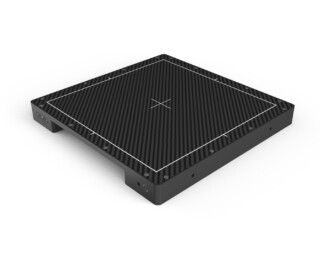

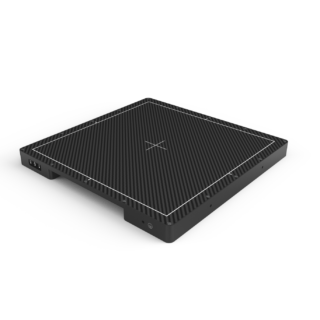

Detection Technology is a global provider of X-ray imaging subsystems and components for medical, security and industrial applications. Detection Technology’s net sales totaled EUR 43 million in 2015. The company has around 160 active customers in 40 countries. Detection Technology employs 340 people in Finland, China and the US. The company’s shares are listed at the NASDAQ First North Finland.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

Attachments: Detection Technology Plc Financial Statements Review 2015 (pdf)