This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

Detection Technology Plc half-yearly report January-June 2023

Detection Technology Plc company announcement 3 August 2023 at 09:00 (EEST)

DETECTION TECHNOLOGY PLC HALF-YEARLY REPORT JANUARY-JUNE 2023

Detection Technology Q2 2023: Double-digit growth, measures in place to improve profitability

April-June 2023 highlights

- Net sales increased by 10.8% to EUR 25.2 million (22.8)

- Net sales of Industrial Solutions Business Unit (IBU) decreased by -6.2% to EUR 3.7 million (4.0)

- Net sales of Medical Business Unit (MBU) increased by 22.3% to EUR 12.4 million (10.1).

- Net sales of Security Business Unit (SBU) increased by 5.0% to EUR 9.1 million (8.6)

- Operating profit (EBIT) excluding non-recurring items (NRI) was EUR 1.4 million (1.2)

- Operating margin (EBIT-%) excluding NRI was 5.4% of net sales (5.2%)

- Operating profit (EBIT) was EUR 1.4 million (0.9)

- Operating margin (EBIT-%) was 5.4% of net sales (3.8%)

January-June 2023 highlights

- Net sales increased by 11.4% to EUR 48.0 million (43.1)

- Net sales of IBU decreased by -4.7% to EUR 7.2 million (7.5)

- Net sales of MBU increased by 18.4% to EUR 24.5 million (20.7)

- Net sales of SBU increased by 9.7% to EUR 16.3 million (14.9)

- Operating profit (EBIT) excluding non-recurring items (NRI) was EUR 2.8 million (2.7)

- Operating margin (EBIT-%) excluding NRI was 5.9% of net sales (6.3%)

- Operating profit (EBIT) was EUR 2.8 million (2.4)

- Operating margin (EBIT-%) was 5.9% of net sales (5.5%)

UNAUDITED (Figures in parentheses refer to the corresponding period of the previous year.)

President and CEO, Hannu Martola:

“Thanks to decent sales in medical and security applications, our net sales experienced double-digit growth despite the softness in our markets. However, our sales lagged behind our expectations in all business segments, and the double-digit growth is attributed to the soft Q2 of 2022. Profitability remained unsatisfactory, and measures are being taken to resolve this.

Sales in industrial applications improved from Q1 but were still lower than expected. Certain key customers continued to reduce their stocks, and demand in China was low, both of which are reflected in sales in Q2 of 2023. Demand normalized at the end of Q2.

Demand drivers in the medical market remained unchanged, but demand softened on all continents. Despite this weakening, our sales grew, driven by computed tomography (CT) applications. The growth rate is mainly explained by the weak comparison period. Increased uncertainty in the markets is expected to continue at least to the end of the year.

Our security application sales grew, but also less than we expected. Lower-than-expected demand was mainly attributed to stagnation in the Chinese market. Although markets in China were slow, it was delightful to see a boost in demand in the Americas and India. In H2, demand will strengthen, especially in China, where we have received new inquiries and orders. Investments in aviation CT equipment are starting in China and will continue in the United States, where investments by the Transportation Security Administration (TSA) are getting more traction.

Lower-than-expected quarterly sales, sales mix, increase in credit loss provision, and the last spot purchases as remnants of the component shortage impacted our profitability. The development of our profitability has been unsatisfactory. In order to improve our profitability, necessary measures are now being taken.

Regarding our other key figures, it is noteworthy that our cash flow has improved significantly thanks to enhanced trade receivables management. The downside is that it has postponed some sales.

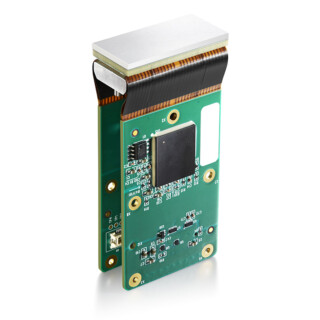

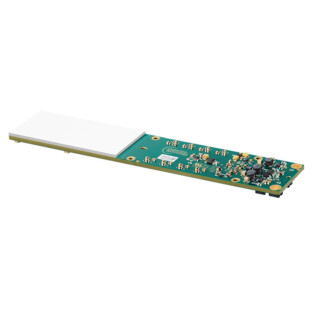

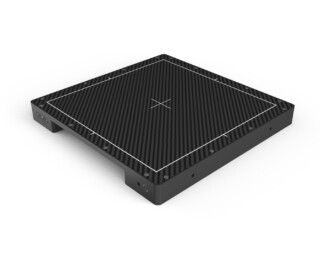

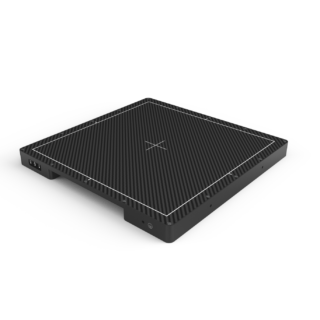

The most significant event in H1 was the acquisition of Haobo Imaging, which we completed right after the end of Q2. This strategically important acquisition enhances customer experience by expanding our offerings to all digital X-ray detector technologies, and supports our long-term growth. Thanks to the acquisition, our product portfolio has expanded significantly, which has been enthusiastically welcomed by the markets, and we expect sales of a couple of million euros in H2 of 2023.

Our decision to invest in new facilities in Oulu, Finland, will also be important in terms of improving our competitiveness and risk management. Our operations in Oulu will move into premises that better support production at the beginning of 2024, and we will have about 30% more net square meters. Thanks to the investment of around one million euros, we are able to offer a wider range of EU-origin products and enhanced customer experience.

There have been positive signals particularly in the security market, but increased uncertainty in the medical market. We expect double-digit growth in the sales of security applications and growth in the sales of industrial applications in Q3. Medical sales, on the other hand, are decreasing. Our total net sales will decline in Q3 and grow in H2 of 2023.”

Key figures

| (EUR 1,000) | 4-6/2023 | 4-6/2022 | 1-6/2023 | 1-6/2022 | 1-12/2022 |

| Net sales | 25,219 | 22,765 | 47,972 | 43,078 | 98,580 |

| Change in net sales, % | 10.8% | -3.3% | 11.4% | 2.9% | 9.8% |

| Operating profit excluding NRI | 1,351 | 1,195 | 2,827 | 2,701 | 6,135 |

| Operating margin excluding NRI, % | 5.4% | 5.2% | 5.9% | 6.3% | 6.2% |

| Non-recurring items (NRI) | 0 | -335 | 0 | -335 | -335 |

| Operating profit | 1,351 | 860 | 2,827 | 2,366 | 5,801 |

| Operating margin, % | 5.4% | 3.8% | 5.9% | 5.5% | 5.9% |

| R&D costs | 3,079 | 3,208 | 6,041 | 6,277 | 12,549 |

| R&D costs, % of net sales | 12.2% | 14.1% | 12.6% | 14.6% | 12.7% |

| Cash flow from operating activities | 2,426 | -4,194 | 1,941 | -3,528 | -294 |

| Net interest-bearing debt at end of period | -18,530 | -18,506 | -18,530 | -18,506 | -20,584 |

| Investments | 376 | 606 | 828 | 807 | 1,628 |

| Return on investment (ROI), % | 6.5% | 13.4% | 6.5% | 13.4% | 7.5% |

| Gearing, % | -27.2% | -25.8% | -27.2% | -25.8% | -28.3% |

| Earnings per share, EUR | 0.03 | 0.05 | 0.09 | 0.14 | 0.35 |

| Earnings per share (diluted), EUR | 0.03 | 0.05 | 0.09 | 0.14 | 0.35 |

| Number of shares at the end of the period | 14,655,930 | 14,655,930 | 14,655,930 | 14,655,930 | 14,655,930 |

| Weighted average number of shares outstanding | 14,655,930 | 14,655,930 | 14,655,930 | 14,655,930 | 14,655,930 |

| Weighted average number of shares outstanding, diluted | 14,662,206 | 14,740,064 | 14,665,894 | 14,778,155 | 14,717,042 |

Business outlook

According to Detection Technology’s view, demand will be strong in security and good in industrial applications. Demand in medical applications has, however, temporarily softened. The company expects its total net sales to decline in Q3 and to grow in H2 of 2023.

However, the geopolitical situation, U.S.–China relations, global economy, inflation, high inventories of certain customers and indirect impacts of the war in Ukraine create uncertainty.

Detection Technology aims to increase its sales by at least 10% per annum and to achieve an operating margin (EBITA) of 15% in the medium term.

Q2 2023 webcast

Hannu Martola, the President and CEO of Detection Technology, will present the Q2 and January–June financial performance and events to analysts, investors, and media at a webcast. The live webcast in English will begin on 3 August 2023 at 13:00 (EEST).

A link to the webcast is available on the company’s website at https://www.deetee.com/reports-and-presentations/webcasts/. A recording of the webcast will be available later on the same web address.

This release is a summary of Detection Technology’s half-yearly report January–June 2023. The complete report can be found attached to the release and on the company’s website.

Board of Directors, Detection Technology Plc

Further information

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EEST).

Hannu Martola, President and CEO

+358 500 449 475, hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under the Nasdaq First North GM rules.

Detection Technology is a global provider of X-ray detector solutions and services for medical, security, and industrial applications. The company’s solutions range from sensor components to optimized detector subsystems with ASICs, electronics, mechanics, software, and algorithms. It has sites in Finland, China, France, and the US. The company’s shares are listed on Nasdaq First North Growth Market Finland under the ticker symbol DETEC.

Distribution: Nasdaq Helsinki, key media, www.deetee.com

Attachments: Detection Technology Plc half-yearly report January-June 2023 (pdf)