This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

DETECTION TECHNOLOGY PLC HALF-YEARLY REPORT JANUARY-JUNE 2017

Detection Technology Plc Company Announcement 26 July 2017 at 9:00 (EEST)

DETECTION TECHNOLOGY PLC HALF-YEARLY REPORT JANUARY-JUNE 2017

Detection Technology Q2 2017: Growth in line with targets, profitability improved

April-June 2017 highlights

-

Net sales increased by 16.8% to EUR 20.4 million (17.5)

-

Net sales of Security and Industrial Business Unit (SBU) decreased 12.6% to EUR 13.1 million (15.0)

-

Net sales of Medical Business Unit (MBU) increased 193.9% to EUR 7.3 million (2.5)

-

Operating profit (EBIT) was EUR 4.1 million (3.2)

-

Operating margin (EBIT-%) was 20.3% of net sales (18.3%)

January-June 2017 highlights

-

Net sales increased by 19.5% to EUR 39.2 million (32.8)

-

Net sales of SBU decreased 6.3% to EUR 25.2 million (26.9)

-

Net sales of MBU grew 135.9% to EUR 14.1 million (6.0)

-

Operating profit (EBIT) was EUR 7.8 million (5.5)

-

Operating margin (EBIT-%) was 19.9% of net sales (16.7%)

(Figures in brackets refer to the corresponding period of the previous year.)

President and CEO, Hannu Martola:

“During the second quarter, business went well and grew in line with our targets. Operating profit increased about 30% compared to last year to EUR 4.1 million. Our net sales exceeded EUR 20 million and grew about 17% from the corresponding period. Operating profit margin was 20%. The company’s cash flow improved fundamentally over the year. The reason for this was a decrease in the amount of working capital tied up in operations and an increase in business profitability.

Sales split between businesses, application areas as well as geographically continued to balance. The exceptional growth period in X-ray imaging equipment demand for security applications in China has slowed. However, we have performed very well in the medical X-ray imaging market. Because of this, the net sales of MBU grew 194% compared to the second quarter last year.

The good performance of MBU was due to the favorable market environment, but also due to our successful customer projects. The improving US economy and good demand in emerging markets have increased our sales. In addition, our recently developed products are now being shipped at full-speed. On the other hand, the relative improvement is partly because of the low level of net sales last year. MBU’s deliveries to the US market also increased the Americas’ share of our net sales.

Net sales of SBU decreased 13%, which is mainly because the strong demand growth in China has stopped. Thanks to official regulations in China, demand was exceptionally strong last year. Investments required by the regulations to scan parcels have been completed for now, and deliveries have evened out. In addition, the competitive environment has tightened, and there is more price pressure.

Our R&D expenses were lower than usual because of the timing of the projects. We expect R&D expenses to increase during the second half of the year.

We continue to develop the business in line with our strategy. In connection with this, we will start new product development projects, and focus on improving our customer relationships and competitiveness further, as well as winning new customers. Our medium-term business outlook remains unchanged.”

Key figures

| (EUR 1,000) | 4-6/2017 | 4-6/2016 | 1-6/2017 | 1-6/2016 | 1-12/2016 |

| Net sales | 20,375 | 17,451 | 39,239 | 32,823 | 75,509 |

| Net sales growth, % | 16.8% | 87.8% | 19.5% | 79.7% | 76.5% |

| Operating profit | 4,131 | 3,189 | 7,821 | 5,475 | 14,808 |

| Operating margin, % | 20.3% | 18.3% | 19.9% | 16.7% | 19.6% |

| R&D costs | 1,856 | 1,155 | 3,385 | 2,778 | 6,071 |

| R&D costs, % of net sales | 9.1% | 6.6% | 8.6% | 8.5% | 8.0% |

| Cash flow from operating activities | 4,376 | -1,525 | 5,491 | -1,200 | 5,412 |

| Net interest bearing debt at end of period | -9,489 | -2,329 | -9,489 | -2,329 | -8,337 |

| Capital expenditure | 821 | 133 | 1,145 | 1,008 | 1,612 |

| Gearing, % | -28.9% | -9.9% | -28.9% | -9.9% | -27.0% |

| Earnings per share, EUR | 0.25 | 0.18 | 0.44 | 0.28 | 0.81 |

| Number of shares at the end of the period | 13,425,775 | 12,950,975 | 13,425,775 | 12,950,975 | 13,425,775 |

Business outlook

According to industry estimates, an average annual growth rate of global medical X-ray imaging market will be around 5%, security X-ray imaging equipment market 7% and industrial X-ray imaging about 5%.

The company estimates that in the second quarter, the computed tomography (CT) market grew by an annual rate of 3-5%. The company estimates that the medical X-ray imaging market will develop positively. Both in China and in North America the demand is expected to remain good.

Globally, the company expects the demand to remain at the current level. Competition is expected to tighten. The growth of security imaging market in China has slowed down.

Detection Technology’s medium-term business outlook is unchanged. Detection Technology aims to increase sales by at least 15% per annum and to achieve an operating margin at or above 15% in the medium term.

This release is a summary of Detection Technology’s half-yearly report January-June 2017. The complete report is attached to this release as a pdf-file and can also be downloaded from the company’s website.

Detection Technology Plc

Board of Directors

For more information:

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EEST).

Hannu Martola, President and CEO

+358 500 449 475

hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under First North rules.

Detection Technology Plc

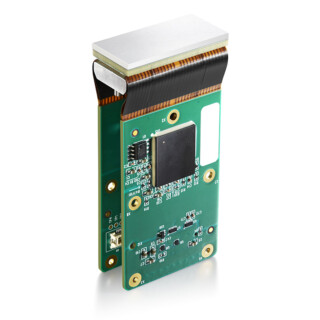

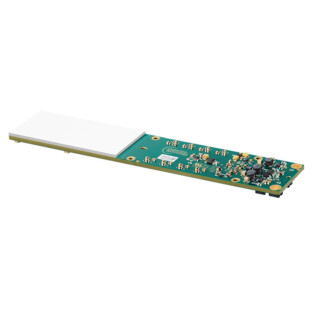

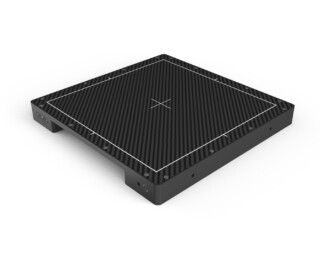

Detection Technology is a global provider of X-ray imaging subsystems, components and services for medical, security and industrial applications. The company’s net sales grew 77% to EUR 76 million in 2016. The company has over 200 customers in 40 countries. Detection Technology employs over 400 people in Finland, China and the US. The company’s shares are listed at the Nasdaq First North Finland under the ticker symbol DETEC.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

Attachments: Detection Technology Plc Half-yearly report January-June 2017 (pdf)