This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

Detection Technology Plc financial statements review January-December 2020

Detection Technology Plc company announcement 2 February 2021 at 09:00 (EET)

DETECTION TECHNOLOGY PLC FINANCIAL STATEMENTS REVIEW JANUARY-DECEMBER 2020

Detection Technology Q4 2020: Headwind in security and growth in medical business, competitive position strengthened

October-December 2020 highlights

- Net sales decreased by -20.4% to EUR 19.9 million (25.0)

- Net sales of Security and Industrial Business Unit (SBU) decreased by -45.5% to EUR 9.0 million (16.4)

- Net sales of Medical Business Unit (MBU) increased by 27.7% to EUR 10.9 million (8.6)

- Operating profit (EBIT) excluding non-recurring items (NRI) was EUR 2.3 million (3.9)

- Operating margin (EBIT-%) excluding NRI was 11.8% of net sales (15.6%)

- Operating profit (EBIT) was EUR 2.3 million (3.2)

- Operating margin (EBIT-%) was 11.8% of net sales (12.8%)

- Earnings per share were EUR 0.16 (0.12)

January-December 2020 highlights

- Net sales decreased by -20.4% to EUR 81.6 million (102.5)

- Net sales of SBU decreased by -38.6% to EUR 42.3 million (68.9)

- Net sales of MBU grew by 16.9% to EUR 39.3 million (33.6)

- Operating profit (EBIT) excluding NRI was EUR 8.9 million (17.7)

- Operating margin (EBIT-%) excluding NRI was 10.9% of net sales (17.3%)

- Operating profit (EBIT) was EUR 8.7 million (17.0)

- Operating margin (EBIT-%) was 10.7% of net sales (16.6%)

- Earnings per share were EUR 0.47 (0.87)

- Dividend EUR 0.28 per share* (0.38)

UNAUDITED (Figures in parentheses refer to the corresponding period of the previous year.) (*The Board of Directors’ proposal to the AGM.)

President and CEO, Hannu Martola:

”COVID-hit 2020 culminated in decreasing sales in security applications partly compensated by growth in all other businesses. Demand increased in medical CT (computed tomography) applications, but the headwind caused by COVID-19 led to a halt in both the mobility of people and investments in security. The gap in security sales was too wide for medical CT sales to close. Thanks to our cost-saving activities and lower employer contribution costs we achieved a double-digit profit margin. The strengthening of our competitive position in all our businesses is worth mentioning.

The number of active customers increased by almost 20% in 2020 to reach 330 at the end of the review period: we won new customers in all our businesses. For this, I express my warm thanks to our team! Net growth was strongest in the industrial sector, which holds plenty of potential, although it is more fragmented than the security and medical markets, which are dominated by larger-scale operators.

We won new customers and projects in the security sector. I’m particularly happy that we were successful in attracting new major security CT projects, which further strengthens our position in the segment. We have also had successful product launches in the security segment, in both CT and line scanner applications, which we expect to bear fruit in terms of sales as demand normalizes. The dramatic drop in SBU sales was due to the exceptionally low demand attributed to stagnation of investments in the security market.

Demand in the industrial segment increased slightly, despite the persistence of wariness to invest. We have strengthened our competitive position in industrial imaging by expanding our product portfolio to cover more demanding imaging needs and, at the moment, we have the widest offering in the market.

MBU sales grew strongly as demand for medical CT applications remained at a good level, driven by investments in healthcare. After the increase in sales at the beginning of the year characterized by COVID-19, CT sales focused on more advanced devices, and the demand of our standard X-Tile product also held its ground. Demand for dental applications has almost normalized in China, and recovery continued in other parts of the world, too, although the full recovery of global demand will take time. This is also why X-Panel sales have had a slow start. We are in a good position to face 2021 in the medical market, thanks to our increased number of customers and expanding product portfolio.

Our flexible, asset-light business model has helped us to grow, and now to minimize the negative ramifications of the COVID-19 pandemic on our business this year. We believe that our business model will also support our future growth as the markets recover. Growth drivers in all our target markets are at the right place, and we are able to flexibly meet the increasing demand as the security market is revived.

We are seeking profitable growth by actively developing our business in line with the DT-2025 strategy. Our Beijing subsidiary was granted the High and New Technology (HNTE) classification in the review period. The HNTE status will significantly reduce the subsidiary’s corporate income tax rate and offers a number of other benefits related to local innovation and our brand value, to name but a few.

We are also looking to boost our growth by means of a new business structure. We split the SBU into two separate business units at the end of the year. The new SBU focusses on security application sales, while the newly-launched Industrial Solutions Business Unit (IBU) champions the industrial segment. We will report on the sales of all three business units separately as of Q1 2021. Industrial sales accounted for over EUR 10 million of SBU sales in 2020.

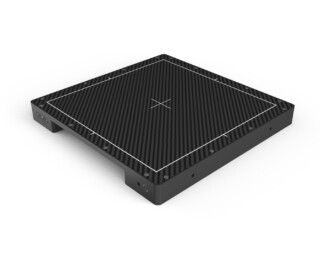

The organizational changes are aimed at obtaining a more streamlined view of the development and needs of the markets, even better customer service, and market-driven business development. We will profile the development of the IBU as a spearhead in its field. Our objective is to complement our industrial portfolio with higher-end detector solutions, beyond hardware, in which software and algorithms play a more significant role. The X-Scan ME series based on multi-energy technology, which was launched at the beginning of the review period, serves as a good example: it received an enthusiastic welcome from the markets.

We launched small-series production for the ME product line in our new facilities in France on schedule. In addition to the successful product transfers, we invested in the development of added-value production processes at our Wuxi production and service site.

Our business outlook has slightly changed from the previous review period. The medical growth prospect has improved, and return to normal in the security market may be delayed due to the recent change in the COVID-19 pandemic. In our view, demand for our products is strong in the medical segment, and we expect double-digit growth in MBU sales in Q1 and Q2 2021. We do not expect demand in the security market to improve before Q2 2021. SBU sales will decrease in Q1, but is likely to grow in Q2. Demand is still subject to uncertainty, as for example China’s critical infrastructure and rail transport recovery projects have progressed slowly. In turn, we estimate IBU sales to grow in H1. At the Group level, we expect total net sales to decrease in Q1 and grow in H1 of 2021.

Although vaccinations against COVID-19 have made progress and markets have shown positive signals, visibility in the security segment remains limited. Consequently our business has been hit by a high level of uncertainty. We will continue strengthening our competitiveness, and at this point leave our medium-term growth and profitability targets unchanged.”

Key figures

| (EUR 1,000) | 10-12/2020 | 10-12/2019 | 1-12/2020 | 1-12/2019 |

| Net sales | 19,909 | 25,021 | 81,561 | 102,480 |

| Change in net sales, % | -20.4% | -2.5% | -20.4% | 9.1% |

| Operating profit excluding NRI | 2,349 | 3,912 | 8,877 | 17,719 |

| Operating margin excluding NRI, % | 11.8% | 15.6% | 10.9% | 17.3% |

| Non-recurring items (NRI) | 0 | 699 | 163 | 699 |

| Operating profit | 2,349 | 3,213 | 8,714 | 17,019 |

| Operating margin, % | 11.8% | 12.8% | 10.7% | 16.6% |

| R&D costs | 2,239 | 2,661 | 9,827 | 10,706 |

| R&D costs, % of net sales | 11.2% | 10.6% | 12.0% | 10.4% |

| Cash flow from operating activities | 3,301 | 8,360 | 7,522 | 11,599 |

| Net interest-bearing debt at end of period | -19,364 | -20,385 | -19,364 | -20,385 |

| Investments | 1,494 | 1,859 | 3,081 | 4,041 |

| Return on investment (ROI), % | 13.6% | 28.5% | ||

| Gearing, % | -33.1% | -34.9% | -33.1% | -34.9% |

| Earnings per share, EUR | 0.16 | 0.12 | 0.47 | 0.87 |

| Number of shares at end of period | 14,375,430 | 14,375,430 | 14,375,430 | 14,375,430 |

Business outlook

Prior to the outbreak of the COVID-19 pandemic, industry experts estimated that the global medical X-ray imaging equipment market would grow at an average rate of about 5% per annum, the security segment by 6% and the industrial sector by about 5%. In Detection Technology’s view, the medical and industrial markets will grow according to the estimates by the experts, but the market disruption caused by the pandemic will continue in the security market, and the said market will decline in H1 of 2021. The latest estimates in market research indicate that post-pandemic growth will compensate the lower demand during the pandemic and, as a result, the security segment will grow more strongly after the temporary market disruption, and will reach the pre-pandemic market estimate around 2025.

Detection Technology expects growth in IBU sales and double-digit growth in MBU sales in H1 of 2021. Demand in the security market is expected to head for growth in Q2 of 2021 at the earliest. SBU sales will decrease in Q1 year-on-year, but will start to grow in Q2, although demand is still subject to uncertainty. Total net sales is expected to decrease in Q1 and grow in H1 of 2021.

The COVID-19 pandemic creates extraordinary uncertainty for the global economy and the company’s business, and the predictability of the company’s target markets is still lower than usual. Detection Technology aims to increase sales by at least 10% per annum and to achieve an operating margin at or above 15% in the medium term.

Q4 2020 webcast

Hannu Martola, the President and CEO of Detection Technology, will present the Q4 and January–December financial performance and events to analysts, investors and media at a webcast. The live webcast in English will begin on 2 February 2021 at 13:00 (EET).

A link to the webcast is available on the company’s website at https://www.deetee.com/investors/reports-and-presentations/webcasts/. A recording of the webcast will be available later on the same web address.

This release is a summary of Detection Technology’s financial statements review January-December 2020. The complete report can be found attached to the release and on the company’s website.

Board of Directors, Detection Technology Plc

Further information

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EET).

Hannu Martola, President and CEO

+358 500 449 475, hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under the Nasdaq First North GM rules.

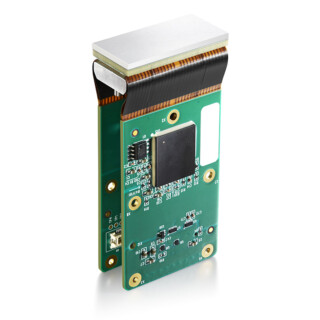

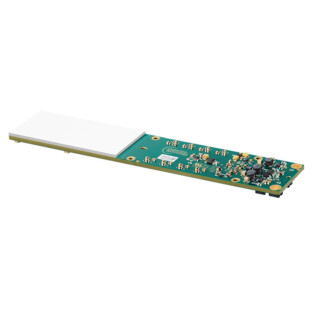

Detection Technology Plc

Detection Technology is a global provider of X-ray detector solutions for medical, security, and industrial applications. The company’s solutions range from photodiodes to optimized detector subsystems with ASICs, electronics, mechanics, software and algorithms. It has sites in Finland, China, France, and the US. The company’s shares are listed on Nasdaq First North Growth Market Finland under the ticker symbol DETEC.

Distribution: Nasdaq Helsinki, key media, www.deetee.com

Attachments: Detection Technology Plc financial statements review January-December 2020 (pdf)