This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

DETECTION TECHNOLOGY PLC FINANCIAL STATEMENTS REVIEW JANUARY-DECEMBER 2017

Detection Technology Plc Company Announcement 2 February 2018 at 9:00 (EET)

DETECTION TECHNOLOGY PLC FINANCIAL STATEMENTS REVIEW JANUARY-DECEMBER 2017

Detection Technology Q4 2017: Strong growth and excellent result

October-December 2017 highlights

-

Net sales increased by 17.0% to EUR 27.5 million (23.5)

-

Net sales of Security and Industrial Business Unit (SBU) increased by 30.8% to EUR 19.4 million (14.8)

-

Net sales of Medical Business Unit (MBU) decreased by 6.4% to EUR 8.2 million (8.7)

-

Operating profit (EBIT) was EUR 7.0 million (5.2)

-

Operating margin (EBIT-%) was 25.4% of net sales (22.3%)

-

Earnings per share were EUR 0.38 (0.31)

January-December 2017 highlights

-

Net sales increased by 17.9% to EUR 89.0 million (75.5)

-

Net sales of SBU increased by 3.8% to EUR 57.9 million (55.8)

-

Net sales of MBU grew by 57.5% to EUR 31.1 million (19.8)

-

Operating profit (EBIT) was EUR 19.9 million (14.8)

-

Operating margin (EBIT-%) was 22.3% of net sales (19.6%)

-

Earnings per share were EUR 1.09 (0.81)

-

Dividend EUR 0.35 per share* (capital repayment 0.25)

UNAUDITED (Figures in parentheses refer to the corresponding period of the previous year.) (*The Board of Directors’ proposal to the AGM.)

President and CEO, Hannu Martola:

“The year 2017 culminated with a record result and net sales in the last quarter. We were very successful in a highly competitive market, achieving a result that exceeded our expectations and good growth despite the tough comparison figures. The good performance was the result of exceptional success in nearly every one of our company’s key areas.

During the last quarter, net sales improved by 33% from the previous year and totaled 7.0 million euros. The operating margin was 25%. Our net sales increased by 17% from the corresponding period and exceeded 27 million euros. SBU’s net sales increased significantly by around 31%. Our net sales grew particularly in the area of critical infrastructure and industrial X-ray imaging applications in Asia. MBU’s sales fell by approximately 6% in the last quarter, which is normal seasonal variation in our business. The growth in SBU’s sales and, on the other hand, the sales decline in MBU reflect the geographic split of our sales. The Asian share of total net sales increased after a short pause.

We succeeded well in the customer interface and earned the trust of 30 new customers during the year. We now have 240 active customers. We believe that this success in acquiring new customers will balance the sales split somewhat in the future. In terms of sales for the whole year, our five largest customers accounted for approximately 60% of our turnover, which represents a decrease of 9%.

The operating profit of EUR 19.9 million for the full year and operating margin of 22% resulted not only from sales growth but also from effective operations management. As a whole, our fixed costs were lower than expected. Exceptionally, R&D costs were only 8% of net sales due to higher sales, and successful projects, as well as the timing of projects. We estimate that R&D costs will increase to nearly 10% in 2018.

So far, we have been more successful than expected on the market and in developing our business. However, 2018 will be a challenging year in terms of company growth. We estimate that sales will increase slightly in security and industrial applications, but sales of medical applications will probably decrease. During the first half of the year, it appears that sales for medical applications will grow slightly in comparison to the same period in the previous year. In the latter half of the year, MBU’s sales will decrease as an MBU key customer stops manufacturing a device that uses one of DT’s products. Price competition will be tougher in all our target markets.

We will continue to develop the business in accordance with our strategy to gain new projects and customers. We believe in the long-term growth potential of both our business units, and we will keep the company’s growth and profitability targets unchanged.”

Key figures

| (EUR 1,000) | 10-12/2017 | 10-12/2016 | 1-12/2017 | 1-12/2016 |

| Net sales | 27,530 | 23,527 | 89,003 | 75,509 |

| Change in net sales, % | 17.0% | 54.7% | 17.9% | 76.5% |

| Operating profit | 6,987 | 5,237 | 19,892 | 14,808 |

| Operating margin, % | 25.4% | 22.3% | 22.3% | 19.6% |

| R&D costs | 1,795 | 2,259 | 7,157 | 6,071 |

| R&D costs, % of net sales | 6.5% | 9.6% | 8.0% | 8.0% |

| Cash flow from operating activities | 7,755 | 4,988 | 18,625 | 5,412 |

| Net interest bearing debt at end of period | -21,774 | -8,337 | -21,774 | -8,337 |

| Capital expenditure | 688 | 372 | 1,833 | 1,612 |

| Return on investment (ROI), % | 47.0% | 38.7% | ||

| Gearing, % | -52.3% | -27.0% | -52.3% | -27.0% |

| Earnings per share, EUR | 0.38 | 0.31 | 1.09 | 0.81 |

| Number of shares at end of period | 13,900,595 | 13,425,775 | 13,900,595 | 13,425,775 |

Business outlook

According to Detection Technology’s estimate, the global market for security X-ray equipment grew by approximately 7% during the review period, which corresponds to the forecasts made by market research institutes. Homeland Security Research Corporation (HSRC) estimates that the annual growth rate will be 6.7% (CAGR) in 2017-2021. According to HSRC, this growth is the result of a global increase in security risks. In addition to increased growth in the X-ray device base, HSRC expects an acceleration in the pace of renewal for the old device base. HSRC has not identified viable competing technologies for screening needs in the security market, and it considers the price-quality ratio of X-ray imaging equipment to be overwhelming. (Source: HSRC May 2017 edition, X-ray baggage, cargo, people, container & vehicle screening market 2017-2021).

Detection Technology estimates that the annual growth rate in the industrial X-ray imaging device market is approximately 5%. The company expects growth in the security and industrial markets to remain at a good level and, in particular, it expects growth in the critical infrastructure, vehicle and industrial market segments. The European Civil Aviation Conference Standard 3 (ECAC3) that takes effect in 2020 will increase demand for computed tomography (CT) equipment at European airports.

According to industry estimates, the global medical X-ray imaging market growth is around 5% per year. Detection Technology estimates that the market for medical computed tomography (CT) grew at an annual pace of about 3-5% in the fourth quarter of 2017. Market growth was strongest in Asia, and demand has also developed positively in North America. The company expects the global medical X-ray imaging market to develop favourably.

Detection Technology expects sales for security and industrial applications to increase slightly in 2018. In terms of medical applications, the company estimates that sales will increase in the first half of 2018 and decrease in the second half of the year when a key customer stops manufacturing a device that uses one of DT’s products. Price competition will be tougher in all of the company’s markets in 2018. The company will continue to develop its business in order to gain new customers and projects, and it considers the growth outlook in both business units to be good in the longer term.

Detection Technology’s medium-term business outlook is unchanged. Detection Technology aims to increase sales by at least 15% per annum and to achieve an operating margin at or above 15% in the medium term.

This release is a summary of Detection Technology’s financial statements review January-December 2017. The complete report is attached to this release as a pdf-file and can also be downloaded from the company’s website.

Detection Technology Plc

Board of Directors

For more information:

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EET).

Hannu Martola, President and CEO

+358 500 449 475

hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under First North rules.

Detection Technology Plc

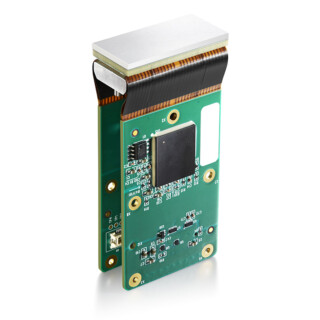

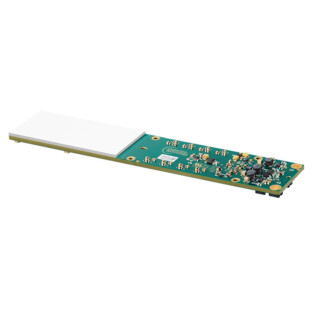

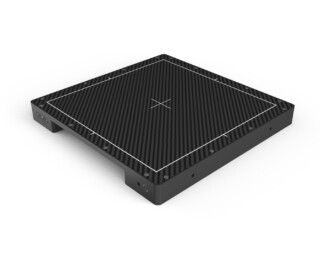

Detection Technology is a global provider of X-ray imaging subsystems, components and services for medical, security and industrial applications. The company’s net sales grew 18% to EUR 89 million in 2017. The company has 240 customers in 40 countries. Detection Technology employs over 400 people in Finland, China and the US. The company’s shares are listed on the Nasdaq First North Finland marketplace under the ticker symbol DETEC.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

Attachments: Detection Technology Plc financial statements review Jan-Dec 2017 (pdf)