This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

Detection Technology Plc business review January-September 2020

Detection Technology Plc company announcement 27 October 2020 at 09:00 (EET)

DETECTION TECHNOLOGY PLC BUSINESS REVIEW JANUARY-SEPTEMBER 2020

Detection Technology Q3: Double-digit EBIT despite continued weakness in the security market

July-September 2020 highlights

- Net sales decreased by -23.4% to EUR 20.6 million (26.9)

- Net sales of Security and Industrial Business Unit (SBU) decreased by -43.1% to EUR 10.6 million (18.6)

- Net sales of Medical Business Unit (MBU) increased by 20.2% to EUR 10.1 million (8.4)

- Operating profit (EBIT) excluding non-recurring items (NRI) was EUR 2.8 million (5.1)

- Operating margin (EBIT-%) excluding NRI was 13.4% of net sales (19.1%)

- Operating profit (EBIT) was EUR 2.6 million (5.1)

- Operating margin (EBIT-%) was 12.6% of net sales (19.1%)

January-September 2020 highlights

- Net sales decreased by -20.4% to EUR 61.7 million (77.5)

- Net sales of Security and Industrial Business Unit (SBU) decreased by -36.4% to EUR 33.3 million (52.5)

- Net sales of Medical Business Unit (MBU) increased by 13.2% to EUR 28.3 million (25.0)

- Operating profit (EBIT) excluding NRI was EUR 6.5 million (13.8)

- Operating margin (EBIT-%) excluding NRI was 10.6% of net sales (17.8%)

- Operating profit (EBIT) was EUR 6.4 million (13.8)

- Operating margin (EBIT-%) was 10.3% of net sales (17.8%)

UNAUDITED (Figures in brackets refer to the corresponding period of the previous year.)

Key figures

| (EUR 1,000) | 7-9/2020 | 7-9/2019 | 1-9/2020 | 1-9/2019 | 1-12/2019 |

| Net sales | 20,628 | 26,934 | 61,653 | 77,459 | 102,480 |

| Change in net sales, % | -23.4% | 9.5% | -20.4% | 13.5% | 9.1% |

| Operating profit excluding non-recurring items (NRI) | 2,758 | 5,148 | 6,528 | 13,807 | 17,719 |

| Operating margin excluding NRI, % | 13.4% | 19,1% | 10.6% | 17.8% | 17.3% |

| Non-recurring items (NRI) | 163 | 0 | 163 | 0 | 699 |

| Operating profit | 2,595 | 5,148 | 6,365 | 13,807 | 17,019 |

| Operating margin, % | 12.6% | 19.1% | 10.3% | 17.8% | 16.6% |

| R&D costs | 2,282 | 2,602 | 7,588 | 8,046 | 10,706 |

| R&D costs, % of net sales | 11.1% | 9.7% | 12.3% | 10.4% | 10.4% |

| Cash flow from operating activities | 2,052 | 3,328 | 4,221 | 3,240 | 11,599 |

| Net interest-bearing debt at end of period | -17,557 | -13,885 | -17,557 | -13,885 | -20,385 |

| Investments | 578 | 775 | 1,587 | 2,182 | 4,041 |

| Gearing, % | -31.0% | -24.5% | -31.0% | -24.5% | -34.9% |

| Earnings per share, EUR | 0.12 | 0.28 | 0.30 | 0.74 | 0.87 |

| Number of shares at end of period | 14,375,430 | 14,375,430 | 14,375,430 | 14,375,430 | 14,375,430 |

President and CEO, Hannu Martola:

”The third COVID quarter presented little surprises and was a sequel to Q2 both in terms of market dynamics and actuals. COVID-19 continued to batter the security market, and the medical CT market had a fair tailwind. Decreasing demand in security applications resulted in a decrease in our year-on-year net sales. Even though our sales decreased, our profitability remained healthy. Good cost discipline regarding fixed costs and the employer’s contribution relief from China improved profitability compared to Q2. Medium-term growth drivers are sound in all our target markets, and we are cautiously optimistic that the worst may already be behind us.

MBU sales remained on the growth path, thanks to good demand in medical CT (computed tomography) applications. Demand for CT applications in each product category normalized, and the sales of higher-end devices grew in Q3. In our view, this trend will continue in Q4, both in terms of product mix and sales. The global dental markets showed signs of recovery, but the demand has not yet normalized, and therefore we have moderate expectations regarding X-Panel sales.

The exceptional market situation had a dramatic impact on SBU sales. The security market was characterized globally by stagnation and the industrial market by wariness to invest. Despite these temporary challenges, the fundamentals of the security market have not changed. The CT equipment updates required by the new aviation standards continued and will be expanded both in terms of geography and applications. We have continued commercial and pilot deliveries to these latest equipment categories, whose commissioning has been reported from Canberra, Hong Kong, London, Milan, Seoul, Singapore, and a number of US-based airports in the review period. Security CT applications have also been commissioned in other critical infrastructure, for example in a law court in Sydney, Australia.

We have worked hard to strengthen our competitiveness and customer relations. The Aurora CT product family launched in Q2 has been warmly welcomed in the markets, we have not lost customers and we have even managed to win new accounts during these COVID-ridden months – we feel we are well prepared for the opening of the security market. We have received signals indicating slow recovery in critical infrastructure and rail transport in the Chinese market. We believe SBU sales will follow the overall trend.

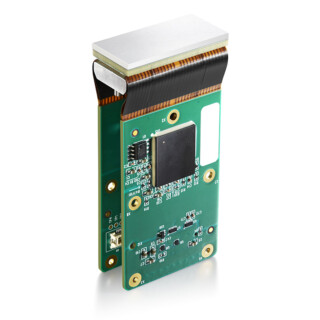

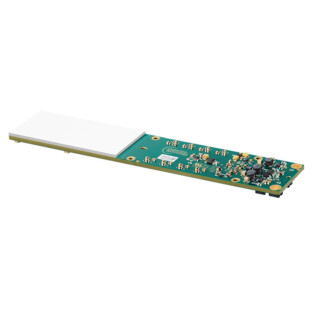

In order to secure our competitiveness, we continued to accelerate our product development cycle and expanded our product portfolio. The X-Panel product family welcomed a new member, the 1412 panel size. We launched two models: the d model is intended for dental and the i model for industrial applications. The launching of the 1412i model was a strategically important opening move for us in a new product segment.

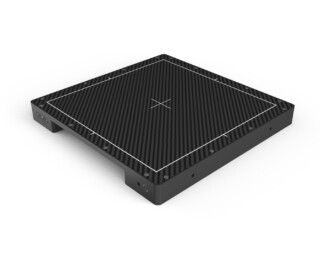

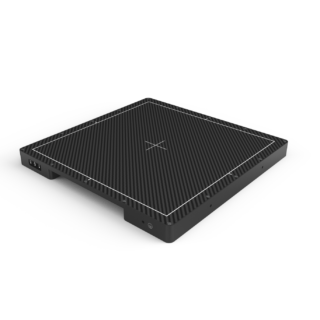

Moving our French operations to new facilities did not slow down our speed on the multi-energy (ME) front either; we launched a new detector series based on the ME technology immediately after the review period. The X-Scan ME product family is a much-awaited addition to demanding industrial imaging and an important milestone in the commercialization of ME technology.

The consequences of COVID-19 reflected all our target markets. Despite the slightly positive signals from the Chinese market, visibility is still extremely poor, particularly in the security market. Our business has been hit by exceptionally high–albeit temporary–levels of uncertainty. We monitor both the movements in the markets and our business development particularly closely, and we are ready to adapt our operations to ensure profitable growth.

When writing this report, medical CT demand seems to be continuing strongly, and MBU sales are expected to grow in Q4. We expect the growth in MBU sales to continue in Q1 of 2021, albeit more slowly. The security market is expected to head for growth in Q2 of 2021 at the earliest, and the lower-than-usual growth in the industrial segment is expected to continue at least until the end of 2020. SBU year-on-year sales are expected to decrease in Q4, but we expect to see a positive turn driven by Chinese demand in H1 of 2021. We will continue strengthening our competitiveness and keep our medium-term growth and profitability targets unchanged.”

Markets

The consequences of the COVID-19 pandemic negatively affected the demand for X-ray devices in all the company’s target markets, apart from medical CT imaging in Q3. Despite strong growth in medical CT sales, Detection Technology’s total net sales decreased by -23.4% (9.5%) to EUR 20.6 million (26.9).

All target markets of the Security and Industrial Business Unit (SBU) continued to be challenging in Q3. The positive trend in air transport emerging in the summer started to fade again towards the fall. Apart from domestic air transport in China, global air transport failed to recover, which resulted in exceptionally low demand in the field of aviation. In addition, extensive restrictions on mass gatherings negatively affected demand in security applications. In the industrial market, demand only grew slightly in the food and pharmaceutical industries. However, this lagged behind the typical annual growth rate of the industry, below 5%. As a result, SBU net sales decreased by -43.1% (42.3%) year-on-year, totalling EUR 10.6 million (18.6).The high percentage decrease is partly attributed to the high year-on-year comparison figure. SBU generated a total of 51.3% (69.0%) of the company’s net sales.

Demand in medical CT applications remained at a good level, resulting in the increase in the year-on-year net sales of the Medical Business Unit (MBU) by 20.2% (-27.6%), a total of EUR 10.1 million (8.4). The peak in the demand for basic imaging devices caused by COVID-19 passed, and CT demand normalized in all product categories. MBU sales focused on higher-end devices, and consequently the growth in sales was mainly attributed to new CT products, such as X-Tile. In addition to China, the global dental market showed signs of recovery in other market areas, but equipment sales have not recovered yet, which slowed down X-Panel sales. MBU generated a total of 48.7% (31.0%) of the company’s net sales.

Asia was the company’s largest geographical market area, with its 66.2% (71.2%) share. The Americas’ share of the company’s net sales was 7.5% (7.8%) and that of Europe 26.3% (21.0%). The company’s top five customers accounted for 52.9% (57.6%) of the company’s total net sales.

Operating profit excluding non-recurring items (NRI) was EUR 2.8 million (5.1) in Q3, corresponding to 13.4% (19.1%) of net sales. NRI totalling EUR 0.2 million (0.0) were registered in the review period related to the reorganization of the Group structure. Operating profit amounted to EUR 2.6 million (5.1), corresponding to 12.6% (19.1%) of net sales.

The company’s investments in the commercialization of the multi-energy (ME) technology, the new facility in France and the commissioning of the production and service site in Wuxi, China, adversely affected profitability on the one hand. On the other hand, decreased personnel expenses, decreased traveling and other cost-saving measures improved profitability compared to Q2. In addition, the company was granted employer’s contribution relief in Q3 of some EUR 0.3 million and in the review period January-September 2020 EUR 0.8 million by the local government in China.

The company’s net sales decreased by -20.4% to EUR 61.7 million (77.5) in January–September 2020. Operating profit amounted to EUR 6.4 million (13.8), corresponding to 10.3% (17.8%) of net sales.

SBU net sales in January–September totalled EUR 33.3 million (52.5), which was -36.4% lower year-on-year. MBU net sales increased by 13.2% totalling EUR 28.3 million (25.0). SBU’s share of net sales was 54.1% (67.7%) and MBU’s 45.9% (32.3%).

Asia’s share of the company’s net sales in the review period January–September 2020 was 66.1% (65.1%), that of the Americas 11.3% (13.4%) and that of Europe 22.6% (21.5%). The company’s top five customers accounted for 53.2% (60.1%) of the company’s total net sales in January–September 2020.

Strategy

Detection Technology has continued developing its business in line with the DT-2025 strategy, despite the extraordinary challenges in the business environment. In order to ensure its competitiveness, the company continued speeding up its product development cycle and expanded its product portfolio. Detection Technology launched a new panel size in its X-Panel product family in September, and expanded the product family from dental applications to industrial imaging, which is a strategically significant milestone for the company. The company launched two 1412 models: the d model is intended for dental and the i model for industrial applications. The company envisages growth potential for panel solutions in various industrial applications, such as the quality control of pipelines, casts, welds, batteries and electronics.

The company’s French operations moved to new facilities at the end of September. The new facilities better support product development and small-series production. The move did not have an impact on projects, and the company launched a new product family based on the multi-energy (ME) technology immediately after the end of the review period. X-Scan ME is the first industrialized multi-energy solution that meets the high requirement level of demanding industrial imaging. The company’s goal is to start the production of the ME product line by the end of 2020. The company expects a positive result from the new business in about two years.

Product transfers to the Wuxi production and service site have progressed as planned. The production of sub-systems with a higher value added level of assembly was launched at the new site in the review period. This category includes, among others, the X-Scan and X-Panel product families.

Business outlook

Prior to the outbreak of the COVID-19 pandemic, industry experts estimated that the global medical X-ray imaging equipment market would grow at an average rate of about 5% per annum, the security segment by 6% and the industrial sector by about 5%. In Detection Technology’s view, the market disruption caused by the pandemic will continue in all of its main markets, with the exception of medical CT imaging, and the annual growth rate in all other segments will be lower than the aforementioned estimates in 2020 and in H1 of 2021. According to the latest estimates by market research, post-pandemic growth will compensate slower demand during the pandemic resulting in about 5% compound annual growth rate (CAGR) in the security segment in 2020–2025.

Detection Technology expects MBU sales to grow in Q4 and to continue to grow in Q1 of 2021, albeit more slowly than in 2020. The security market is expected to head for growth in Q2 of 2021 at the earliest, and the lower-than-usual growth in the industrial segment is expected to continue at least until the end of 2020. SBU net sales are thus expected to decrease in Q4 year-on-year, but the company expects them to improve in H1 of 2021.

The COVID-19 pandemic creates extraordinary uncertainty for the global economy and the company’s business, and the predictability of the company’s target markets is still lower than usual. Detection Technology aims to increase sales by at least 10% per annum and to achieve an operating margin at or above 15% in the medium term.

Financial statements review 2020

Detection Technology will publish its financial statements review for 2020 on 2 February 2021.

Espoo, Finland 26 October 2020

Board of Directors, Detection Technology Plc

Further information

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EET).

Hannu Martola, President and CEO

+358 500 449 475, hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under the Nasdaq First North GM rules.

Detection Technology Plc

Detection Technology is a global provider of X-ray detector solutions for medical, security, and industrial applications. The company’s net sales totaled EUR 102 million in 2019. The company has 280 customers in 40 countries. Detection Technology employs around 500 people in Finland, China, France, and the US. The company’s shares are listed on Nasdaq First North Growth Market Finland under the ticker symbol DETEC.

Distribution: Nasdaq Helsinki, key media, www.deetee.com

Attachments: Detection Technology Plc business review January-September 2020 (pdf)