This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

Detection Technology Plc business review January—March 2022

Detection Technology Plc company announcement 27 April 2022 at 09:00 (EEST)

DETECTION TECHNOLOGY PLC BUSINESS REVIEW JANUARY–MARCH 2022

Detection Technology Q1 2022: Strong underlying demand, but component shortage postponed sales

January–March 2022 highlights

• Net sales increased by 10.9% to EUR 20.3 million (18.3)

• Net sales of Industrial Solutions Business Unit (IBU) increased by 45.2% to EUR 3.5 (2.4)

• Net sales of Medical Business Unit (MBU) increased by 4.5% to EUR 10.5 million (10.1)

• Net sales of Security Business Unit (SBU) increased by 7.5% to EUR 6.3 million (5.8)

• Operating profit (EBIT) was EUR 1.5 million (1.4)

• Operating margin (EBIT-%) was 7.4% of net sales (7.5%)

UNAUDITED (Figures in parentheses refer to the corresponding period of the previous year.)

Key figures

| (EUR 1,000) | 1-3/2022 | 1-3/2021 | 1-12/2021 |

| Net sales | 20,313 | 18,323 | 89,813 |

| Change in net sales, % | 10.9% | -8.0% | 10.1% |

| Operating profit | 1,506 | 1,382 | 10,580 |

| Operating margin, % | 7.4% | 7.5% | 11.8% |

| R&D costs | 2,942 | 2,405 | 10,480 |

| R&D costs, % of net sales | 14.5% | 13.1% | 11.7% |

| Cash flow from operating activities * | 666 | 1,098 | 7,121 |

| Net interest-bearing debt at end of period | -28,247 | -20,641 | -27,633 |

| Investments * | 201 | 142 | 1,359 |

| Return on investment (ROI), % | 17.0% | 13.8% | 16.5% |

| Gearing, % | -40.0% | -36.2% | -37.6% |

| Earnings per share, EUR | 0.09 | 0.09 | 0.64 |

| Earnings per share (diluted), EUR | 0.09 | 0.09 | 0.63 |

| Number of shares at the end of the period | 14,655,930 | 14,375,430 | 14,655,930 |

| Weighted average number of shares outstanding | 14,655,930 | 14,375,430 | 14,500,514 |

| Weighted average number of shares outstanding, diluted | 14,816,245 | 14,617,185 | 14,766,934 |

*Reporting of conversion differences in the Group cash flow statement changed during the financial year 2021. In comparable reporting period of January—March 2021, material conversion differences have been eliminated from the cash flow items.

President and CEO, Hannu Martola:

“Demand continued to be strong in all our main markets. All our businesses grew, and our total net sales experienced double-digit growth. We did, however, have higher expectations for security application sales, in particular. The component shortage increasingly limited growth, and part of the sales were postponed in all our businesses. Product modifications that aim to mitigate the impacts of the supply issues progressed well, and our ability to meet the growing demand is improving.

The escalation of the COVID pandemic in China and the war in Ukraine did not have a significant impact on our net sales and financial result in Q1. We succeeded in minimizing the impacts of COVID lockdowns in China, and we have only had minor business in the areas in crisis prior to the Ukraine war and none after the outbreak.

Strong demand in the main applications of the industrial market continued in the review period, and the Q1 sales of the IBU grew significantly. Our growth rate for Q1 could have been even higher without the challenges posed by the shortage of components.

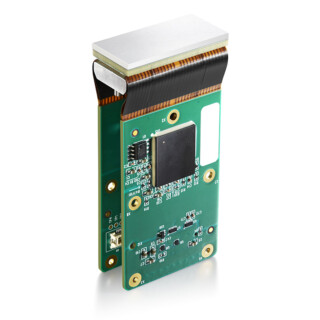

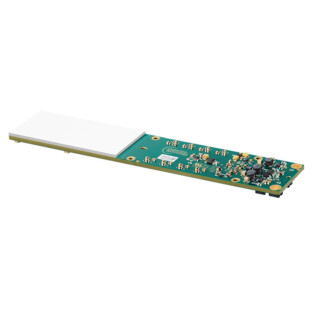

Growth in the medical market continued at a good level, and there were no significant changes in the market’s growth drivers. Our MBU sales originated mainly from computed tomography (CT) applications, in which we have further strengthened our position thanks to our new standard solutions. The X-ACE product family that was launched at the end of last year has been warmly welcomed in the value and mainstream equipment markets. Unfortunately, this segment was not either immune to the component shortage, which direct and indirect impacts held back growth in sales.

Demand in the security market grew from the previous quarter, also in the aviation sector. The upgrade of airport scanners with CT equipment progressed, particularly in the US where the Transportation Security Administration (TSA) allocated new orders. The upgrade of equipment will also increase the demand for our solutions, but SBU sales in Q1 mainly originated from non-aviation applications. Despite the positive atmosphere in the market, SBU sales lagged behind our expectations due to the supply challenges.

Obviously, the supply issues also had an impact on our other key figures. As a result, we have had to resort to spot purchasing, which somewhat decreased our profitability. Our R&D costs were also higher due to product modifications.

In the review period, we focused on the design and implementation of product modifications as well as the evaluation of alternative suppliers. We will complete the first stage of our product modification project at the end of Q2 and the second stage at the end of Q3 of 2022. We expect that the project will improve our ability and reliability to deliver as of Q3 in all our businesses.

Despite the challenges, the outlook for H1 and the rest of 2022 has slightly improved. In our view, demand will gain further strength in all our main markets and in all our three businesses. We expect double-digit growth in industrial and security sales in Q2. In contrast, it is likely that medical revenue will decline in Q2, as sales will be postponed due to indirect impacts of the Shanghai lockdown affecting customers. We expect to see double-digit growth in our total net sales in H1 of 2022, although some sales have been postponed due to challenges in the supply chain, and intensifying growth in all our businesses in H2.

Although we have taken measures to mitigate the impacts of the shortage of components, direct and indirect challenges in availability and longer delivery times may have an impact on our ability to meet growing demand. There is increasing cost pressure, but we have so far been able to avoid any significant increases. We are also closely monitoring the war in Ukraine and its direct and indirect impacts on our business. If the situation requires, we will adjust our business to minimize the aforementioned risks.”

The development of net sales

In Q1 of 2022, demand continued to be strong in all Detection Technology’s main markets: industrial, medical, and security applications. The company’s total net sales grew by 10.9% (-8.0%), totaling EUR 20.3 million (18.3). Demand would have allowed for a higher growth rate in net sales, but the global shortage of materials and components postponed some of the sales in all market segments. The escalation of the COVID-19 pandemic in China and the war in Ukraine did not have a significant impact on the outcome.

In the industrial market, demand continued to be strong in all of the company’s main segments: imaging solutions for the food, pharmaceutical, and mining industries. As a result, the net sales of the Industrial Solutions Business Unit (IBU) grew by 45.2%, totaling EUR 3.5 million (2.4). There would have been higher potential for growth in sales, but the company’s ability to deliver was eroded by the component shortage, and some of the sales of industrial solutions were postponed. IBU generated a total of 17.4% (13.3%) of the company’s total net sales.

There were no significant changes in the growth drivers in the medical market during Q1. There was strong demand in computed tomography (CT) applications both in developing and developed countries. The escalation of the COVID-19 pandemic in China temporarily slowed down the recovery of the dental market. The net sales of the Medical Business Unit (MBU) increased by 4.5% year-on-year, driven by demand in CT applications. MBU sales were not immune to the challenges in the supply chain; the direct and indirect consequences of component shortage slowed down growth in sales in Q1. MBU’s net sales totaled EUR 10.5 million (10.1). MBU generated a total of 51.8% (54.9%) of the company’s total net sales.

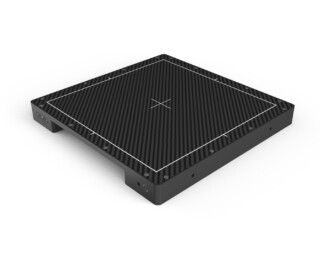

The positive atmosphere in the security market continued and demand grew in all segments, including in the aviation sector. Aviation standardization projects continued across various continents, and investments in airport CT equipment gained strength, particularly in the United States. This has resulted in an increasing demand in security CT detector solutions, but the growth in the net sales of the company’s Security Business Unit (SBU) still mainly originated from applications other than those used in the aviation sector. Delivery challenges attributed to the shortage of components significantly eroded the result of the review period, and some of the SBU sales were postponed. SBU’s net sales increased by 7.5% year-on-year, totaling EUR 6.3 million (5.8). SBU generated a total of 30.9% (31.8%) of the company’s total net sales.

The Asia-Pacific countries (APAC) accounted for the company’s largest geographical market area in Q1 of 2022, with its 71.1% (76.5%) share. The share of the net sales for Europe, the Middle East and Africa (EMEA) was 23.3% (17.6%) and the Americas 5.6% (5.9%). The share of total net sales accounted for by Detection Technology’s top five largest customers was 58.2% (62.7%).

Strategy

In the review period January–March 2022, the company continued to implement its DT-2025 strategy as planned and to develop its business to improve competitiveness. Detection Technology carried out tactical measures to mitigate the challenges in the availability of special materials and electronic components. The company had a large-scale ongoing project to design product modifications to its entire product portfolio, including industrial, medical and security solutions.

Detection Technology launched operations at the new Nanjing unit in the beginning of the year. The company has carried out the first recruitments in order to improve its ability to meet the growing demand in higher-end detector solutions in which software and algorithms play a central role. The company’s objective is to develop the Nanjing site into a talent hub of software, firmware, algorithm, and electronics development.

The company also continued to develop its feedback and leadership culture as well as the development of the procedures supporting its redefined values. In addition, the company continued the rollout and development of the operating model of its global research and development organization (R&D), intended to promote the DT-2025 strategy, as planned.

Business outlook

According to Detection Technology’s view, demand will continue to be strong in all of the company’s main markets. The company expects double-digit growth in total net sales both in Q2 and H2 of 2022, although the shortage of materials and components is expected to postpone at least some of the growth in Q2.

Due to the war in Ukraine, the pandemic and inflation, the global economy and the company’s businesses face uncertainty. Predictability of the company’s target markets is lower than usual, and direct and indirect risks related to the availability of materials remain elevated. The effect of material and component shortage has been acknowledged as a limiting factor in the outlook, however a further degradation in supply chain might affect the business outlook.

Detection Technology aims to increase sales by at least 10% per annum and to achieve an operating margin at or above 15% in the medium term.

Half-yearly report 2022

Detection Technology will publish the half-yearly report on 3 August 2022.

Espoo, Finland 26 April 2022

Board of Directors

Detection Technology Plc

Further information

President and CEO Hannu Martola will be available for interviews and further information on the release date at 9:00-11:00 (EEST).

Hannu Martola, President and CEO

+358 500 449 475, hannu.martola@nulldeetee.com

Nordea is the company’s Certified Advisor under the Nasdaq First North GM rules.

Detection Technology is a global provider of X-ray detector solutions for medical, security, and industrial applications. The company’s solutions range from sensor components to optimized detector subsystems with ASICs, electronics, mechanics, software and algorithms. It has sites in Finland, China, France, and the US. The company’s shares are listed on Nasdaq First North Growth Market Finland under the ticker symbol DETEC.

Distribution: Nasdaq Helsinki, key media, www.deetee.com

Attachments: Detection Technology Plc business review January—March 2022 (pdf)