This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

DETECTION TECHNOLOGY: GOOD GROWTH CONTINUED – INVESTMENTS IN R&D AND PRODUCTION SUPPORT FUTURE GROWTH

DETECTION TECHNOLOGY PLC INTERIM REPORT JANUARY-JUNE 2015

Detection Technology Plc Company Announcement 30 July 2015 at 9.00 a.m. local time

DETECTION TECHNOLOGY: GOOD GROWTH CONTINUED – INVESTMENTS IN R&D AND PRODUCTION SUPPORT FUTURE GROWTH

This release is a summary of Detection Technology’s Interim Report January-June 2015. The complete report is attached to this release as a pdf-file and can also be found on the company website www.deetee.com

SECOND QUARTER 2015 HIGHLIGHTS

-

Net sales amounted to EUR 9.29 million (7.75), a growth of 20% (8% at comparable exchange rates)

-

Operating profit (EBIT) amounted to EUR 0.56 million (0.89)

-

Operating margin (EBIT%) 6.0% of net sales (11.5%)

-

Earnings per share were 0.02 euros (0.06)

HIGHLIGHTS OF THE REVIEW PERIOD JANUARY-JUNE 2015

-

Net sales amounted to EUR 18.3 million (14.7), a growth of 24% (12% at comparable exchange rates)

-

Operating profit (EBIT) amounted to EUR 1.30 million (1.26)

-

Operating margin (EBIT%) 7.1% of net sales (8.6%)

-

DT was listed on the Nasdaq First North Finland market place on March 16th

-

The result for the period was affected by non-recurring financial expenses of EUR 1.43 million related to the IPO

-

Earnings per share were -0.01 euros (0.07)

DETECTION TECHNOLOGY’S PROSPECTS FOR 2015 UNCHANGED

Detection Technology’s sales outlook for 2015 is in accordance with its medium term target to increase sales by at least 15% per annum. DT’s profitability is developing according to plan. DT’s net sales and profitability can vary considerably between the quarters due to the timing of projects and customer deliveries.

The total capital expenditure related to the new factory in Beijing, China and other investments are estimated to amount to EUR 4.5-5.0 million in 2015.

PRESIDENT AND CEO, HANNU MARTOLA:

“The second quarter development was good and our net sales grew 20%. During the quarter new business with new and existing customers developed favorably and we continue to see good growth opportunities in both our businesses.

We are currently investing in the new factory in Beijing, in product development and R&D as well as putting efforts in our customer relations. Costs related to these large projects had an impact on our profitability but support our continued future growth. Quarterly variations in DT’s net sales and profitability are also common due to the timing of bigger customer deliveries and variations in manufacturing volumes.

The setting up of our new factory in Beijing is proceeding according to plan and production will be ramped-up during the autumn of 2015.”

KEY FIGURES

| (EUR 1 000) | 4-6/2015 | 4-6/2014 | Change | 1-6/2015 | 1-6/2014 | Change | 1-12/2014 |

| Net sales | 9 292 | 7 746 | 20% | 18 265 | 14 677 | 24% | 33 112 |

| Net sales growth % | 20 | -10 | 24 | -4 | 9 | ||

| Operating profit* | 561 | 891** | -37% | 1 302 | 1 261** | 3% | 3 079*** |

| Operating margin* | 6.0% | 11.5% | 7.1% | 8.6% | 9.3% | ||

| Operating profit (EBIT) excl. NRI | 561 | 1 191 | -53% | 1 302 | 1 561 | -17% | 4 127 |

| Operating margin (EBIT) excl. NRI | 6.0% | 15.4% | 7.1% | 10.6% | 12.5% | ||

| Cash flow from operating activities | -2 629 | 1 047 | -351% | -2 059 | 435 | -573% | 3 085 |

| Net interest bearing debt at end of period | -7 166 | 9 542 | -175% | -7 166 | 9 542 | -175% | 8 678 |

| Capital expenditure | 310 | 199 | 56% | 857 | 346 | 148% | 1 280 |

| Gearing, % | -37 | -1 103 | 634.8 | ||||

| Earnings per share, EUR | 0.02 | 0.59 | -96% | -0.01 | 0.64 | -102% | 1.45 |

| Earnings per share diluted, EUR | 0.02 | 0.06 | -69% | -0.01 | 0.07 | -114% | 0.21 |

| Number of shares at the end of the period | 12 950 975 | 1 900 195 | 12 950 975 | 1 900 195 | 1 900 195 |

*As of 2015 DT has made a change in the treatment of potential future warranty costs and makes a provision of 1.5% of net sales. The warranty provision affects the January-June 2015 operating profit by EUR 0.23 million.

** In Q2/2014 DT recognized EUR 0.3 million of non-recurring quality and NPI costs

***In 2014, DT recognized EUR 1.0 million of non-recurring quality and NPI costs

The earnings per share information for 2014 figures was computed as if the shares issued in conjunction with the IPO had been outstanding for the entire comparison period.

Board of Directors

DETECTION TECHNOLOGY PLC.

For further information:

| Hannu Martola, President and CEO |

| +358 500 449475 |

| hannu.martola@nulldeetee.com |

Nordea is the company’s Certified Advisor under First North rules.

Detection Technology in brief

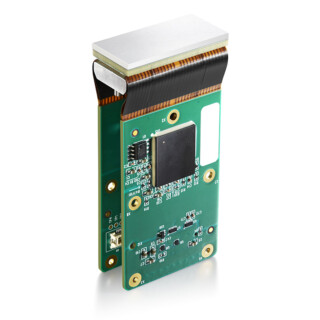

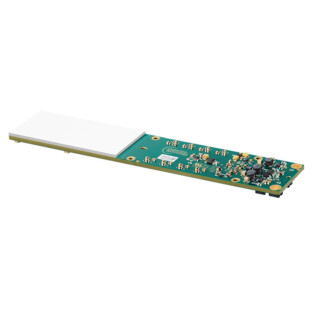

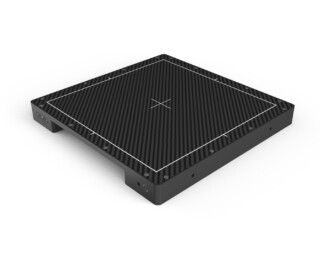

Detection Technology develops, produces, markets and sells components and systems for X-ray imaging solutions for medical, security and industrial applications. The Company operates from Espoo, Oulu, Beijing, Hong Kong and Boston. In 2014, Detection Technology’s net sales totalled EUR 33 million and the comparable operating profit margin was 12% (the reported operating profit margin being 9%). The company’s shares are listed on the Nasdaq First North Finland market place.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

Attachments: Detection Technology Plc January-June 2015 interim review (pdf)