This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

DETECTION TECHNOLOGY APPLIES FOR LISTING OF ITS SHARES ON THE FIRST NORTH FINLAND MARKETPLACE

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, HONG KONG, SOUTH AFRICA, SINGAPORE OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL.

DETECTION TECHNOLOGY APPLIES FOR LISTING OF ITS SHARES ON THE FIRST NORTH FINLAND MARKETPLACE

The Board of Directors of Detection Technology Plc (“Detection Technology” or the “Company”), and its certain shareholders (the “Selling Shareholders”), have decided to apply for listing of the shares of Detection Technology on the First North Finland marketplace maintained by NASDAQ OMX Helsinki Ltd (“First North”) and arrange a share issue (the “Share Issue”) and share sale (the “Share Sale”), collectively referred to as the “Offering”. Detection Technology is one of the leading X-ray detector providers globally.

The offering in brief

-

The Offering is expected to begin on or about 3 March 2015. Trading of the Company’s shares is expected to commence on or about 16 March 2015 and the shares will trade under the symbol “DETEC”.

-

The Company’s shares in the Offering will be offered to private individuals and organisations in Finland (the “Public Offering”), to the Company’s personnel (the “Personnel Offering”) and to institutional investors in Finland and internationally (the “Institutional Offering”).

-

The Offer Shares represent approximately 72.6 per cent of the Company’s shares and votes before the Offering, assuming that all Offer Shares preliminarily offered in the Offering are fully subscribed and sold and the over-allotment option is not used.

-

Detection Technology will offer for subscription a maximum of 3 450 000 new shares in the Company (the “Issue Shares”), raising approximately EUR 20 million in new capital in conjunction with the Offering before Offering related costs.

-

In the Share Sale, the Selling Shareholders will offer for purchase a maximum of 3 447 817 shares in the Company (the “Sale Shares”, and together with the Issue Shares the “Offer Shares”).

-

The preliminary subscription price range for the Offer Shares is a minimum of EUR 5.20 and a maximum of EUR 6.40 per share (the “Preliminary Subscription Price Range”).

-

Prior to the execution of the Offering, Oy G.W. Sohlberg Ab is the Company’s largest shareholder holding approximately 71.4 per cent of the shares on the date of the Finnish language prospectus. If the Offering is carried out in full, Oy G.W. Sohlberg Ab’s proportion of the shares in the Company and number of votes is estimated to decrease to approximately 42.8 per cent or approximately 38.8 per cent if the over-allotment option is used in its entirety.

-

A Finnish language prospectus with full terms and conditions will be published today 2 March 2015 on the Company’s website (www.deetee.com).

Hannu Martola, President and CEO of Detection Technology

“Detection Technology has grown strongly during the last years; between 2009 and 2014 our compounded annual growth exceeded 30%. Today we are one of the leading suppliers of detectors for X-ray imaging and we have a solid technology base which we aim to continue to build on. We see big potential for continued growth and believe that a public listing would enable us to serve our customers better. The funds raised from the listing would be used to further strengthen our technology base, for investments in our production capabilities and for our continued global expansion.”

Andreas Tallberg, Chairman of the Board of Directors and President and CEO of main shareholder Oy G.W. Sohlberg Ab

“Detection Technology is in a very interesting development phase serving highly attractive markets. We believe that the Company is ready to take the next step and that a public listing would support its growth targets. GWS has been the main shareholder in Detection Technology since 2007 and our intention is to remain as a large shareholder as in our view the prospects for further value creation are highly attractive. Hannu Martola and his team have done an outstanding job developing the Company into one of the leading suppliers in X-ray technology components and systems with a strong track record of profitable growth.”

The Offering

The subscription period for the Institutional Offering will commence on 3 March 2015 at 10.00 a.m. (Finnish time) and end on 13 March 2015 at 12 noon (Finnish time) at the latest. The subscription period for the Public Offering will commence on 3 March 2015 at 10.00 a.m. (Finnish time) and end on 12 March 2015 at 4.00 p.m. (Finnish time) at the latest. The subscription period for the Public Offering for subscriptions made in Nordea Netbank and Nordea customer service with bank codes will commence on 3 March 2015 at 10.00 a.m. and end on 12 March 2015 at 4.00 p.m. (Finnish time) at the latest. The subscription period for the Public Offering for e-subscriptions made over the Internet will commence on 3 March 2015 at 10.00 a.m. (Finnish time) and end on 6 March 2015 at 4.00 p.m. (Finnish time). The Company and the Selling Shareholders have, in the event of an oversubscription, the right to discontinue the Institutional Offering and the Public Offering at the earliest on 9 March 2015 at 4.00 p.m. (Finnish time). The Institutional Offering and the Public Offering can be discontinued independently of each other. A company release regarding the matter will be published in the event of a possible discontinuation of the Institutional Offering and/or the Public Offering.

Detection Technology has today filed an application with NASDAQ OMX Helsinki Ltd for listing of the Company’s shares on First North under the share trading code DETEC. The trading on First North is expected to commence on or about 16 March 2015.

Nordea acts as the Lead Manager and bookrunner of the Offering. Shares in the Public Offering will be available for subscription at the subscription places in Nordea and further details are available in the Finnish language prospectus. The Preliminary Subscription Price Range for the Offer Shares is a minimum of EUR 5.20 and a maximum of EUR 6.40 per share. The Board of Directors of the Company and the Selling Shareholder shall decide on the completion of the Offering, the number of Offer Shares, and the final subscription price for the Offer Shares, after the book building period directed at institutional investors has ended, on or about 13 March 2015.

The Company will use the proceeds received from the Share Issue to develop its business operations, among others:

- to investments required by the planned new factory in Beijing, China, and

- expanding technological know-how and offering through the Company’s own research and development know-how as well as through possible acquisitions.

The proceeds from the Share Issue also enable strengthening the Company’s capital structure and financial position. The Offering also serves to increase the number shareholders in the Company, increase the general interest towards and awareness of the Company, provide the Company with access to capital markets, and increase the liquidity of the Shares. Through the Offering, the Shares can also more effectively be used in potential acquisitions and in rewarding the Company’s personnel and key persons.

The Offering comprises preliminarily a maximum of 6 897 817 Offer Shares, of which the Selling Shareholders will offer for purchase preliminary a maximum of 3 447 817 Sale Shares and the Company will offer for subscription preliminary a maximum of 3 450 000 Issue Shares. The Institutional Offering comprises preliminarily a maximum of 6 208 035 shares in the Company.The Company and the Selling Shareholders may, based on demand, transfer offered shares without any restrictions between the Institutional Offering and the Public Offering in deviation from the preliminary number of Offer Shares. However, the minimum number of Company’s shares to be offered in the Public Offering shall be 551 825 shares in the Company or, if the aggregate number of Company’s shares covered by the subscription commitments submitted in the Public Offering is smaller than this, such aggregate number of shares in the Company as covered by the commitments submitted in the Public Offering. Persons participating in the Personnel Offering may be given preference in the allocation of the Offer Shares in the Public Offering. The Company intends to accept the subscription commitments by persons participating in the Personnel Offering in full for up to 4 250 Offer Shares.

In the event of an oversubscription, Oy G.W. Sohlberg Ab has agreed to grant the Lead Manager an over-allotment option exercisable within 30 days from the commencement of trading of the shares of the Company on First North, i.e. on or about the time period from 16 March 2015 to 14 April 2015, to purchase or to procure purchasers for up to 517 173 additional Shares in the Company solely to cover over-allotments (the “Over-Allotment Option”). Unless otherwise specified or clear from the context, information concerning the Offer Shares also concern possible Shares to be sold on basis of the Over-Allotment Option. Over-Allotment Option shares represent a maximum of approximately of 5.4 per cent of all the Shares in the Company and their voting rights prior to the Offering and a maximum of approximately 4.0 per cent following the Offering, provided that all the Offer Shares are subscribed and the Over-Allotment Option is used in its entirety.

The Lead Manager has entered into a share lending agreement with Oy G.W. Sohlberg Ab. In connection with the Offering, the Lead Manager may, but is not obligated to, within 30 days from the commencement of the trading of the Offer Shares on First North, engage in measures which stabilise, maintain or otherwise may affect the price of the Shares in the Company by maintaining a level, which would not otherwise prevail in an open trade (stabilization). Any stabilization measures will be conducted in accordance with the European Commission Regulation (EC) No 2273/2003 implementing Directive 2003/6/EC of the European Parliament and of the Council as regards exemptions for buy-back programmes and stabilization of financial instruments.

The Finnish language prospectus will be available from 2 March 2015 electronically on Company’s webpage at www.deetee.com/listautumisanti and at www.nordea.fi/osakkeet and from 3 March 2015 as a printed version during normal business hours at the at the offices of the Company in Ahventie 4B, FI-02170 Espoo, Finland and Elektroniikkatie 10, FI-90590 Oulu, Finland, Nordea Bank Finland Plc’s branches in Finland (except branches with cash services only) and Nordea Private Banking units in Finland, as well as at the Helsinki Stock Exchange located at Fabianinkatu 14, FI-00100 Helsinki, Finland.

Additional information about the Company is appended to this announcement. Appendix A includes the terms of the Offering and Appendix B a short description of Detection Technology. The appended information should be read together with the Finnish language prospectus in order to attain a comprehensive view of the Company.

Nordea Bank Finland Plc acts as the Lead Manager in the Offering and serves also as the Company’s certified advisor under the First North rules. Borenius Attorneys Ltd acts as the legal advisor to the Company in the Offering while White & Case LLP acts as the legal advisor to the Lead Manager.

DETECTION TECHNOLOGY PLC.

Board of Directors

Further information:

Detection Technology Plc.

| Hannu Martola, President and CEO | Andreas Tallberg, Chairman of the Board of Directors |

| +358 500 449475 | +358 40 7002252 |

| hannu.martola@nulldeetee.com | andreas.tallberg@nullgws.fi |

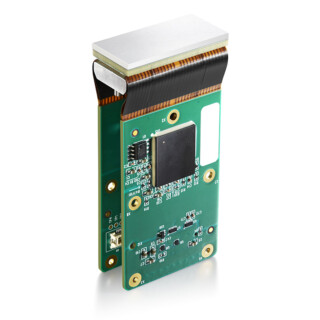

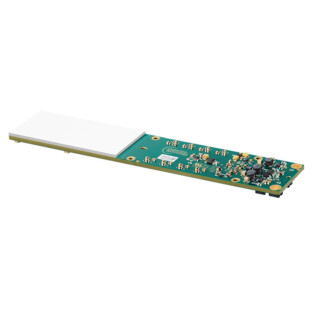

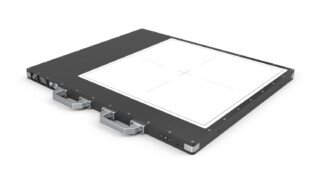

Detection Technology develops, produces, markets and sells components and systems for X-ray imaging solutions. The Company’s products include high performance, reliable and cost-efficient X-ray imaging components and systems such as photodiodes, photodiode arrays, application specific integrated circuits (ASICs), detectors and detector systems for medical, security and industrial X-ray imaging applications. The Company operates from offices and production facilities in Espoo, Oulu, Beijing, Hong Kong and Boston.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

DISCLAIMER:

The information contained herein is not for publication or distribution, directly or indirectly, in or into the United States, Canada, Australia, Hong Kong, South Africa, Singapore or Japan.

These written materials do not constitute an offer of securities for sale in the United States, nor may the securities be offered or sold in the United States absent registration or an exemption from registration as provided in the U.S. Securities Act of 1933, as amended, and the rules and regulations thereunder. Detection Technology Plc. (the “Company”) does not intend to register any portion of the offering in the United States or to conduct a public offering of securities in the United States.

The issue, exercise and/or sale of securities in the initial public offering are subject to specific legal or regulatory restrictions in certain jurisdictions. Neither the Company nor Nordea Bank Finland Plc assume any responsibility in the event there is a violation by any person of such restrictions.

The information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the securities referred to herein in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any such jurisdiction. Investors must neither accept any offer for, nor acquire, any securities to which this document refers, unless they do so on the basis of the information contained in the applicable prospectus published or offering circular distributed by the Company.

The Company has not authorized any offer to the public of securities in any Member State of the European Economic Area other than Finland. With respect to each Member State of the European Economic Area other than Finland and which has implemented the Prospectus Directive (each, a “Relevant Member State”), no action has been undertaken or will be undertaken to make an offer to the public of securities requiring publication of a prospectus in any Relevant Member State. As a result, the securities may only be offered in Relevant Member States (a) to any legal entity which is a qualified investor as defined in the Prospectus Directive; or (b) in any other circumstances falling within Article 3(2) of the Prospectus Directive. For the purposes of this paragraph, the expression an “offer of securities to the public” means the communication in any form and by any means of sufficient information on the terms of the offer and the securities to be offered so as to enable an investor to decide to exercise, purchase or subscribe the securities, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State and the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

This communication does not constitute an offer of the securities referred to herein to the public in the United Kingdom. No prospectus has been or will be approved in the United Kingdom in respect of the securities referred to herein. This communication is directed only at (i) persons who are outside the United Kingdom or (ii) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) and (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2) of the Order (all such persons together being referred to as “relevant persons”). Any investment activity to which this communication relates will only be available to and will only be engaged with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

APPENDIX A

TERMS AND CONDITIONS OF THE OFFERING

The term “subscription” refers in the following to the investor’s offer or commitment in the Offering, irrespective of whether the investor has offered or committed to buy Sale Shares or subscribe for Issue Shares. Similarly the terms “subscriber”, “subscription period”, “subscription place”, subscription price”, “subscription offer” and “subscription commitment” (or other similar terms) refer to both the Share Issue and Share Sale.

General Description

Offering

In the Share Issue and Share Sale (defined below in sections “ – Share Issue” and “ – Share Sale”, together the “Offering“), preliminarily a maximum of 6,897,817 shares (the “Offer Shares“) in Detection Technology Plc. (the “Company“) will be offered to institutional investors in Finland and internationally (the “Institutional Offering“), to private individuals and organisations in Finland (the “Public Offering“) and to the Company’s personnel (the “Personnel Offering“). Terms and conditions of the Public Offering apply to the Personnel Offering unless expressly stated otherwise. Only new Shares of the Company are offered in the Personnel Offering and a discount will be applied to the subscription price of the Personnel Offering as described later in the terms and conditions. The Offer Shares represent approximately 72.6 per cent of the Company’s shares and votes before the Offering and a maximum of approximately 53.3 per cent after the Offering, assuming that all Offer Shares preliminarily offered in the Offering are fully subscribed for and sold and the Over-Allotment Option is not used.

The terms and conditions of the Offering are comprised of the general terms and conditions of the Offering presented herein as well as the special terms and conditions of the Institutional Offering and the Public Offering.

Share Issue

The Annual General Meeting of Shareholders of the Company resolved on 12 February 2015 to authorise the Board of Directors of the Company to decide on an increase in the number of the Company’s shares by a total of 4,500,000 new shares. Based on the authorisation granted by the General Meeting of Shareholders, the Board of Directors resolved on 26 February 2015 preliminarily to issue a maximum of 3,450,000 new shares (the “Issue Shares“) by way of an offer to institutional investors in Finland and internationally and private individuals and entities in Finland (the “Share Issue“). The Issue Shares are offered in deviation from the shareholders’ pre-emptive subscription right in order to enable the listing of the Company’s shares on a multilateral trading facility First North Finland. The payment made to the Company for the approved Issue Share subscriptions will be booked in its entirety in the invested unrestricted equity fund. Thus, the Company’s share capital will not increase in connection with the Share Issue. As a result of the Share Issue, the number of the Company’s shares can increase to a maximum of 12,950,975 shares. The Issue Shares represent approximately 36.3 per cent of the Company’s shares and votes before the Offering and approximately 26.6 per cent after the Offering, assuming that all Offer Shares preliminarily offered in the Offering are fully subscribed for and sold and the Over-Allotment Option is not used.

Share Sale

The Company’s shareholders identified in Appendix 1 (the “Selling Shareholders“) will offer for purchase preliminarily a maximum of 3,447,817 shares (the “Sale Shares“) to institutional investors in Finland and internationally and to private individuals and entities in Finland (the “Share Sale“). The shares offered in the Share Sale represent approximately 36.3 per cent of the Company’s shares and votes carried by all the Shares before the Offering and approximately 26.6 per cent after the Offering, assuming that all Offer Shares preliminarily offered in the Offering are fully subscribed for and sold and the Over-Allotment Option is not used. If the Offering was not subscribed for in full and the Offering was nevertheless implemented, the number of Sale Shares would be adjusted to correspond to the subscriptions. When reducing the number of Sale Shares, the number of shares sold by Oy G.W. Sohlberg Ab would be reduced primarily. More information about the Selling Shareholders is found in “Appendix 1 – Selling Shareholders“.

Over-Allotment Option

In the event of oversubscription, Oy G.W. Sohlberg Ab grants the Lead Manager an over-allotment option exercisable within 30 days from the commencement of trading of the Shares on First North, i.e. on or about the time period from 16 March 2015 to 14 April 2015, to purchase or to procure purchasers a maximum of 517,173 Shares in the Company solely to cover over-allotments (the “Over-Allotment Option“). Unless otherwise specified or clear from the context, information concerning the Offer Shares also concerns possible Shares to be sold on basis of the Over-Allotment Option. Over-Allotment Option shares represent a maximum of approximately of 5.4 per cent of all the Shares in the Company and their voting rights before the Offering and a maximum of approximately 4.0 per cent after the Offering, provided that all the Offer Shares are subscribed for and the Over-Allotment Option is used in its entirety.

Stabilisation

In connection with the Offering, the Lead Manager may, but is not obligated to, within 30 days from the commencement of the trading of the Offer Shares on First North, i.e. on or about the time period from 16 March 2015 to 14 April 2015, engage in measures which stabilise, maintain or otherwise affect the price of the Shares which would not otherwise prevail in an open trade (stabilisation). Such measures may be engaged in First North or otherwise. These measures may raise or maintain the market price of the Shares in comparison with the price levels determined independently on the market or may prevent or delay any decrease in the market price of the Shares. However, the stabilisation measures may not be conducted on a higher price than what is the final subscription price in the Offering. The Lead Manager has no obligation to carry out these measures, and it may stop any of these measures at any time. The Lead Manager or the Company on behalf of the Lead Manager will publish information regarding the stabilisation required by legislation or other applicable regulations at the end of stabilisation period.

Any stabilization measures will be conducted in accordance with the European Commission Regulation (EC) No 2273/2003 implementing Directive 2003/6/EC of the European Parliament and of the Council as regards exemptions for buy-back programmes and stabilization of financial instruments.

The Lead Manager has entered into a share lending agreement with Oy G.W. Sohlberg Ab related to the settlement and stabilisation. According to the share lending agreement, the Lead Manager may borrow a number of Shares equal to the Over-Allotment Option to cover any possible over-allotments in connection with the Offering. To the extent that the Lead Manager borrows Shares in this manner, it must return an equal number of Shares or equal rights to Oy G.W. Sohlberg Ab.

Lead Manager

Nordea Bank Finland Plc acts as the lead manager of the Offering (“Nordea” or the “Lead Manager“).

Underwriting Commitment

The Company, the Selling Shareholders and the Lead Manager will, on or about 13 March 2015 enter into an underwriting agreement (the “Underwriting Agreement“). The Underwriting Agreement contains an underwriting commitment by Nordea for the entire Offering (including both the Share Issue and the Share Sale), subject to certain customary conditions. The Offering will not be carried out nor the underwriting agreement will not be entered into if sufficient number of subscriptions of Offer Shares are not attained in the Offering.

Conditionality of the Offering

The Board of Directors of the Company and the Selling Shareholders shall decide on the completion of the Offering, the number of Offer Shares, and the final subscription price for the Offer Shares, after the book building period directed at institutional investors has ended, on or about 13 March 2015. The Offering will not be carried out if sufficient number of subscriptions of Offer Shares are not attained in the Offering. The realisation of the Offering is conditional upon the signing of the Underwriting Agreement.

Subscription Period

The subscription period for the Institutional Offering will commence on 3 March 2015 at 10.00 a.m. (Finnish time) and end on 13 March 2015 at 12 noon (Finnish time) at the latest. The subscription period for the Public Offering will commence on 3 March 2015 at 10.00 a.m. (Finnish time) and end on 12 March 2015 at 4.00 p.m. (Finnish time) at the latest. The subscription period for the Public Offering for subscriptions made in Nordea Netbank and Nordea customer service with bank codes will commence on 3 March 2015 at 10.00 a.m. and end on 12 March 2015 at 4.00 p.m. (Finnish time) at the latest. The subscription period for the Public Offering for E-subscriptions made over the Internet will commence on 3 March 2015 at 10.00 a.m. (Finnish time) and end on 6 March 2015 at 4.00 p.m. (Finnish time).

The Company and the Selling Shareholders have, in the event of an oversubscription, the right to discontinue the Institutional Offering and the Public Offering at the earliest on 9 March 2015 at 4.00 p.m. (Finnish time). The Institutional Offering and the Public Offering can be discontinued independently of each other. A company release regarding the matter will be published in the event of a possible discontinuation of the Institutional Offering and/or the Public Offering.

The Board of Directors of the Company has the right to extend the subscription period of the Offering. A possible extension of the subscription period will be communicated by a company release, which will indicate the new end date of the subscription period of the Offering. The subscription period will end in any case on 28 March 2015 at 4.00 p.m. (Finnish time) at the latest. The Board of Directors of the Company may or may not extend the subscription period of the Institutional Offering or the Public Offering independently of each other. The company release concerning the extension of the subscription period must be released at the latest on the above mentioned estimated end dates of the subscription period of the Institutional Offering and the Public Offering.

Subscription Price

The preliminary subscription price range for the Offer Shares is a minimum of EUR 5.20 and a maximum of EUR 6.40 per Share (the “Preliminary Subscription Price Range“). The Preliminary Subscription Price Range can be changed during the subscription period, which will be then communicated by a company release and on the Internet on the website www.deetee.com/listautumisanti. The final subscription price of the Shares may be above or below the Preliminary Subscription Price Range. See ” – Cancellation of the Subscription Commitment – Procedure for Changing the Preliminary Subscription Price Range“. The final subscription price for the Shares shall be decided based on subscription orders (the “Subscription Order“) submitted by institutional investors in negotiations between the Company, the Selling Shareholders and the Lead Manager after the subscription period has ended on or about 13 March 2015 (the “Pricing“). The final subscription price will be announced by a company release immediately following the Pricing and it shall be available at the latest on the next banking day following the Pricing, on or about 16 March 2015 at the subscription places of the Offering and on the Internet on the website www.deetee.com/listautumisanti. The final subscription price for the Personnel Offering is 10 per cent lower than in the Public Offering.

Cancellation of the Subscription Commitment

The subscription commitment submitted in connection with the Public Offering (the “Commitment“) is binding and cannot be changed or cancelled, otherwise than in the situations provided for in the Securities Markets Act.

Procedure for Changing the Preliminary Subscription Price Range

If the Preliminary Subscription Price Range is changed during the subscription period, the Offering Memorandum shall be supplemented, and such supplement of the Offering Memorandum and change in the Preliminary Subscription Price Range shall be published in a company release and on the Internet on the website www.deetee.com/listautumisanti. If the Preliminary Subscription Price Range is changed or if the final subscription price of the Shares differs from the Preliminary Subscription Price Range, investors who have made a Commitment in the Public Offering before the Preliminary Subscription Price Range was changed or before a final subscription price that differs from the Preliminary Subscription Price Range was announced, may, for at least the next two (2) banking days as of the publication of a new price range or the final subscription price in deviation from the Preliminary Subscription Price Range, cancel the Commitment made earlier.

If the Commitment is not cancelled, the number of Shares of an investor, who has paid for his or her Commitment, is recalculated on the basis of the final subscription price. The investor is, however, entitled to maintain the number of Shares unchanged by paying the difference between the maximum price of the Preliminary Subscription Price Range and the maximum price of the new higher price range of the Preliminary Subscription Price Range or the final subscription price, multiplied by the number of Shares of his or her Commitment during two (2) banking days as of the publication of the new price range or the final subscription price in deviation from the Preliminary Subscription Price Range as instructed by the subscription place.

Cancellation in Accordance with the Securities Markets Act

If the Offering Memorandum is supplemented or corrected due to a material error or omission or due to material new information, which arises in accordance with the Securities Markets Act after the Finnish Financial Supervisory Authority has approved the Offering Memorandum and before the closing of the offer, investors who have committed to subscribe for Offer Shares before the Offering Memorandum was supplemented or corrected have, in accordance with the Securities Markets Act, the right to cancel their Commitments within at least two (2) banking days after the supplement or correction of the Offering Memorandum has been published. The use of the cancellation right requires that the error, omission or material new information, that led to the supplement or correction, has arisen prior to the delivery of the Offer Shares to the investors.

Any possible cancellation of the Commitment must concern fully the aggregate number of Shares of all Commitments of the investor in question. If the Offering Memorandum is supplemented, such an event shall be announced with a company release. Such company release shall also contain information on the investors’ right to cancel their Commitments. The validity of the offer shall be deemed to close when the execution of the Offering, the final subscription price and the allocation has been decided upon, i.e. preliminarily on 13 March 2015.

Procedure to Cancel the Commitment

The cancellation of a Commitment must be notified in writing to the subscription place where the initial Commitment was made and within the time limit set for such cancellation. However, a Commitment made by telephone to Nordea customer service may be cancelled by telephone. Cancelling or changing a Commitment in the Public Offering cannot be made online via Nordea Netbank or E-subscription, but must be made in other Nordea subscription places. The possible cancellation of a Commitment concerns the entire Commitment. After the period entitling to the cancellation right has lapsed, the cancellation right no longer exists. If the Commitment is cancelled, the subscription place returns the sum paid for the Shares to the bank account notified in the Commitment. The money is returned as soon as possible after the cancellation, approximately within three (3) banking days of serving the subscription place with the cancellation notice. If an investor’s bank account is in a different bank than the subscription place, the refund will be paid to a Finnish bank account in accordance with the payment schedule of the financial institutions, approximately no later than two (2) banking days thereafter. No interest will be paid on such repaid funds.

Registration of Shares to Book-Entry Accounts

An investor making a Commitment must have a book-entry account with a Finnish account operator, or with an account operator operating in Finland, and submit the number of his or her book-entry account in the Commitment. Shares issued in the Public Offering are recorded in the book-entry accounts of investors who have made an approved Commitment on or about the first banking day after the Pricing takes place, on or about 16 March 2015. In the Institutional Offering, the Shares will be ready to be delivered against payment on or about 18 March 2015 through Euroclear Finland.

Title and Shareholder Rights

The title to the Sale Shares is transferred when the Shares are paid for and recorded in the investor’s book-entry account. The Sale Shares carry rights equal to all other Shares in the Company and will entitle their holders to dividend and other distributions of funds as well as other rights related to the Shares as of the title has been transferred to him or her. The Issue Shares carry rights equal to all other Shares in the Company and will entitle their holders to dividend and other distributions of funds as well as other rights related to the Shares after the Issue Shares have been registered in the Trade Register on or about 13 March 2015. Rights related to Issue Shares may be used when the Shares are recorded in the investor’s book-entry system.

Each Share entitles to one vote in the Company’s General Meeting of Shareholders.

Transfer Tax and Other Expenses

No transfer tax is payable for subscribing for Issue Shares. Account operators charge a brokerage fee in accordance with their price lists for the maintenance of the book-entry account and for depositing shares.

The Sale Shares shall be sold on a multilateral trading facility in the same instance when trading with the new Shares commences on the First North marketplace, and no transfer tax shall be payable for these trades. The Selling Shareholders shall pay the transfer tax that may possibly be levied when Shares are transferred in connection with the Share Sale.

Trading in the Shares

The Company will submit a listing application with NASDAQ OMX Helsinki Ltd (the “Helsinki Stock Exchange“) to list the Shares on the multilateral First North Finland marketplace (“First North“) maintained by the Helsinki Stock Exchange. The share trading is expected to commence on First North on or about 16 March 2015. The share trading code of the Shares is DETEC and ISIN code FI4000115464. Nordea acts as the certified advisor referred to in the First North Nordic Rulebook.

When the trading on First North commences on or about 16 March 2015, all Offer Shares issued or sold in the Offering have not necessarily been fully transferred to the investors’ book-entry accounts. When a broker receives an order to sell Shares on First North, the broker shall with due care ensure that the amount of Shares in question has been allocated to the investor.

Right to Cancel the Offering

The Board of Directors of the Company is entitled to cancel the Offering at any time prior to the execution of the Offering due to, among other reasons, a material change in the market conditions, the Company’s financial position or the Company’s business. If the Board of Directors decides to cancel the Offering, the paid subscription prices will be refunded to subscribers approximately in three (3) banking days after the decision by the Board of Directors. If the investor’s bank account is in another financial institution than the subscription place, the refund will be paid to a Finnish bank account in accordance with the payment schedule of the financial institutions, approximately no more than two (2) banking days later. No interest will be paid on such repaid funds.

Other Issues

Other issues and practical matters relating to the Share Issue will be resolved by the Board of Directors of the Company.

Other issues and practical matters relating to the Share Sale will be resolved by the Selling Shareholders.

Documents on Display

The Company’s latest financial statements, the annual report and the auditor’s report as well as the other documents pursuant to Chapter 5, Section 21 of the Companies Act, are available during the subscription period at the offices of the Company in Ahventie 4 B, 02170 FI-Espoo, Finland and Elektroniikkatie 10, FI-90590 Oulu, Finland.

Governing Law

The Offering shall be governed by the laws of Finland. Any disputes arising in connection with the Offering shall be settled by a court of competent jurisdiction in Finland.

Special Terms and Conditions concerning the Institutional Offering

Preliminarily a maximum of 6,208,035 Shares are offered in the Institutional Offering to institutional investors in Finland and internationally on the terms and conditions set forth herein. The number of Shares offered may be more or less than the respective amount presented herein. The Company and the Selling Shareholders may, based on demand, transfer Offer Shares without any restrictions between the Institutional Offering and the Public Offering in deviation from the preliminary number of Shares. However, the minimum number of Shares to be offered in the Public Offering shall be 551,825 Shares or, if the aggregate number of Shares covered by the Commitments submitted in the Public Offering is smaller than this, such aggregate number of Shares as covered by the Commitments submitted in the Public Offering.

The Shares are being offered in the Institutional Offering for investors outside the United States in accordance with Regulation S under the U.S. Securities Act of 1933, as amended. The Shares have not been registered, and they will not be registered under the U.S. Securities Act of 1933, and they cannot be offered or sold into the United States. For more information on the restrictions on the offering of Shares, see “Important Information on the Offering Memorandum“.

The Lead Manager may reject a Subscription Order, either partially or wholly, unless the Commitment has been made in accordance with the terms and conditions herein.

Right to Participate

An investor, whose Subscription Order includes at least 20,000 Shares, may participate in the Institutional Offering.

Subscription Places

Subscription Orders by institutional investors may be submitted to the Lead Manager of the Offering.

Payment of the Offer Shares

Institutional investors must pay for the Shares corresponding to their accepted Subscription Order in accordance with the instructions issued by the Lead Manager, on or about 18 March 2015. The Lead Manager has the right, in accordance with the duty of care set for securities intermediaries, where necessary, upon receipt of a Subscription Order or before approval thereof, to request the subscriber to give an account of its ability to pay for the Shares corresponding to the order or to require an amount corresponding to the order be paid in advance. The amount payable will then be the maximum amount of the Preliminary Subscription Price Range, amounting to EUR 6.40, which is multiplied by the number of Shares corresponding to the Subscription Order. If the Preliminary Subscription Price Range is increased, the maximum price per Share of the new price range will be applied to the orders submitted thereafter. Possible refunds will be made on or about on the fourth (4th) banking day following the Pricing, on or about 19 March 2015. No interest will be paid on such repaid funds.

Approval of the Subscription Orders

The Company and Selling Shareholders decide on the approvals of the submitted Subscription Orders after the Pricing. A confirmation of the accepted Subscription Orders in the Institutional Offering will be provided as soon as practically possible after the allocation of the Offer Shares. The Company and the Selling Shareholders will decide on the procedures in the event of a potential oversubscription. The Subscription Orders can be accepted partially or wholly or they may be rejected.

Special Terms and Conditions concerning the Public Offering

Preliminarily 689,782 Shares are offered in the Public Offering to the Company’s personnel, private individuals and organisations in Finland on the terms and conditions set forth herein. The Company and the Selling Shareholders may, based on demand, transfer offered Shares without any restrictions between the Institutional Offering and the Public Offering in deviation from the preliminary number of Offer Shares. However, the minimum number of Shares to be offered in the Public Offering shall be 551,825 Shares or, if the aggregate number of Shares covered by the Commitments submitted in the Public Offering is smaller than this, such aggregate number of Shares as covered by the Commitments submitted in the Public Offering.

The subscription place has the right to reject a Commitment, either partially or wholly, if the Commitment does not comply with the terms and conditions set forth herein or if it is otherwise incomplete.

Right to Participate, the Minimum and Maximum Amounts for Commitments

Investors, whose domicile is in Finland and who submit their Commitments in Finland, may participate in the Public Offering. Members of the Board of Directors or persons, who are directly employed by the Company or whose election to become a Member of the Board of Directors has been decided at the beginning of the subscription period on 3 March 2015 may participate in the Personnel Offering. However, the persons acting as the Selling Shareholders in the Offering cannot participate in the Personnel Offering even though they would otherwise meet the conditions for participation in the Personnel Offering. The right to participate in the Personnel Offering is personal and cannot be transferred. For more information on the restrictions on the offering of the Shares, see “Important Information on the Offering Memorandum”. In the Public Offering, the Commitment must concern a minimum of 100 Shares and a maximum of 19,999 Shares. Multiple Commitments provided by the same investor in one or several subscription places will be combined into one Commitment and the above maximum amount will be applied thereto. The subscriptions in the Public Offering and Personnel Offering by the same investor will not be combined.

Allocation Privilege of the Personnel Offering and Lock-up

Persons participating in the Personnel Offering may be given preference in the allocation of the Offer Shares in the Offering. The Company intends to accept the Commitments by persons participating in the Personnel Offering in full for a maximum of 4,250 Offer Shares. The proportional amount of the Offer Shares allocated this way is a maximum of approximately 4 per cent of the Offer Shares preliminarily offered in the Public Offering, assuming that all persons having the right to subscribe fully subscribe for the Offer Shares in accordance with their allocation preference.

Persons taking part in the Personnel Offering will not commit to, without the prior written consent of the Lead Manager, offer, pledge, sell, commit to sell, set options or other rights to buy, buy options or rights to buy, give option rights or warranty to buy or otherwise assign or transfer, directly or indirectly, the Shares or other securities exchangeable or convertible to Shares or securities available for subscriptions of the Shares, or engage in exchange or any other agreement by which the economic effects related to ownership of the Shares are transferred fully or partially, irrespective of whether such actions are taken through delivery of Shares or other securities, in cash or otherwise. This commitment is valid for 180 days and 360 days for the Members of the Management Team of the Company who have subscribed for Shares in the Personnel Offering from the commencement of trade with the Shares on First North.

Subscription Places and Submitting of Commitment

The places of subscription in the Public Offering for Nordea customers are:

- Nordea Bank Finland Plc’s branches in Finland (except branches with cash services only) during their respective opening hours,

- Nordea Private Banking units in Finland (only for Nordea Private Banking customers),

- Nordea customer service with bank codes, Monday to Friday 8.00 a.m. to 8.00 p.m. (Finnish time), tel. +358 200 3000 (service in Finnish, local network charge/ mobile call charge[1]), tel. +358 200 5000 (service in Swedish, local network charge/ mobile call charge3) or Monday to Friday 10.00 a.m. to 4.30 p.m. (Finnish time), tel. +358 200 70 000 (service in English, local network charge/ mobile call charge3), and

- Nordea Netbank with bank codes at www.nordea.fi.

The places of subscription in the Public Offering if not a Nordea customer:

- Internet E-subscription without Nordea bank codes at www.nordea.fi, and

- Nordea Bank Finland Plc’s branches in Finland (except branches with cash services only) during their respective opening hours. Information regarding branches that offer subscription services is available through Nordea customer service under tel. +358 200 3000 (service in Finnish, local network charge/ mobile call charge3), tel. +358 200 5000 (service in Swedish, local network charge/ mobile call charge3) or Monday to Friday 10.00 a.m. to 4.30 p.m. (Finnish time), tel. +358 200 70 000 (service in English, local network charge/ mobile call charge3).

The submission of a Commitment by phone and in Nordea Netbank requires a valid Netbank agreement with Nordea. Corporations may not submit Commitments by phone through Nordea Customer Service, Nordea Netbank or E-subscription. The calls with Nordea Customer Service will be recorded.

An individual investor can make subscriptions through the E-subscription in the Public Offering up to EUR 15,000. If the subscription exceeds EUR 15,000, the Commitment can be submitted at a Nordea branch.

The places of subscription in the Personnel Offering are solely Nordea Bank Finland Plc’s branches in Tapiola, Espoo (Länsitulentie 10, 5th floor, FI-02100 Espoo, Finland) and Oulu (Kirkkokatu 6, FI-90100 Oulu, Finland) during their respective opening hours.

The Commitment is deemed to be given when the investor has submitted a duly signed commitment form to a subscription place in accordance with the instructions of the subscription place or confirmed the Commitment with his or her bank codes and paid for the subscription in accordance with the said Commitment. Possible further instructions given by the subscription place must be taken into account when submitting the Commitment. A Commitment submitted in the Public Offering is binding and may not be changed, and its cancellation is possible only in the circumstances mentioned and in the specific way described in section ” – Cancellation of the Subscription Commitment” above.

A Commitment for an E-subscription is deemed to be made when the investor has made the Commitment in accordance with terms and conditions of the E-subscription.

Payment of Offer Shares

When submitting a Commitment in the Public Offering, the amount to be paid for the Shares amounts to the maximum price of the Preliminary Subscription Price Range, EUR 6.40 per Share, multiplied by the amount of Offer Shares in the Commitment. In the Personnel Offering, the amount to be paid for the Offer Shares is ten per cent lower than the maximum price of the Preliminary Subscription Price Range in the Public Offering, EUR 5.76 per Share, multiplied by the amount of Offer Shares in the Commitment. If the Preliminary Subscription Price Range has been changed, thereafter the maximum price per Share of the new price range shall be paid when submitting a Commitment. If the Commitment has been submitted in a branch of Nordea, the payment will be charged from the investor’s bank account in Nordea or it may be paid in cash. The payment corresponding to the Commitment that has been submitted through Nordea Netbank will be charged from the investor’s bank account when the investor confirms the Commitment with his or her bank codes. If the Commitment has been submitted through the E-subscription, the investor shall make the payment in accordance with the terms and conditions of E-subscription without delay after submitting the Commitment.

Acceptance of Commitments and Allocation of the Offer Shares

The Company and Selling Shareholders decide on the allocation of the Offer Shares to investors after the Pricing. The Company and the Selling Shareholders decide on the procedures in the event of a potential oversubscription. The Commitments may be accepted in whole or in part or they may be rejected. The Company and the Selling Shareholders aim to accept Commitments in whole for a maximum of 400 Offer Shares and, for Commitments exceeding this amount, allocate Offer Shares in proportion to the amount of Commitments unmet. The final allocation principles will be announced by a company release immediately after the Pricing, and they will be available at the latest on the following banking day after the Pricing, on or about 16 March 2015 in the subscription places and on the Internet on the website www.deetee.com/listautumisanti. A confirmation letter regarding the acceptance of the Commitments and allocation of the Offer Shares shall be sent on or about 16 March 2015 to all investors that have participated in the Public Offering.

Refunding of Paid Amount

If the Commitment is rejected or only partially accepted and/or if the final subscription price is lower than the amount paid at the time of making the Commitment, the amount paid or part thereof will be refunded to the investor to the bank account identified in the Commitment on or about the fourth (4th) banking day after the Pricing, on or about 19 March 2015. If the investor’s bank account is in another financial institution than the subscription place, the refund will be paid to a Finnish bank account in accordance with the payment schedule of the financial institutions, on or about two (2) banking days later at the latest. If Commitments made by the same investor have been combined, the possible refund is made only to one bank account. No interest will be paid on such repaid funds. See also ” – Cancellation of the Subscription Commitment – Procedure for Changing the Preliminary Subscription Price Range“.

APPENDIX B

Detection Technology in brief

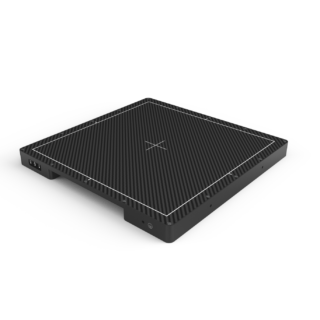

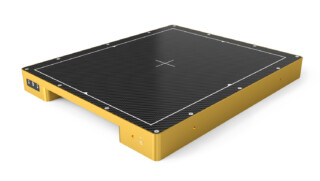

Detection Technology (“DT”) is a supplier of X-ray imaging and detection solutions for leading equipment manufacturers in the medical, security and industrial markets. Detection Technology develops and produces photodiodes, ASICs, electronics, mechanics and software through its research and development centers and manufacturing facilities located in Finland and China.

The Company’s technology-driven products are the result of long-term cooperation with customers, combined with a deep understanding of solid-state X-ray imaging technology and markets.

Detection Technology has two business units, the medical business unit (MBU) and the security and industrial business unit (SBU).

For medical applications, DT provides customized solutions for computed tomography, mammography, bone densitometry, and chest and trauma X-ray. The Company’s product portfolio ranges from photodiodes to complete imaging systems. In 2014, approximately 38% of DT’s net sales derived from the medical business.

Security solutions are used for passenger, baggage and cargo inspections in airports and customs. DT provides off-the-shelf detector products and customized systems for security screening applications. Industrial solutions are used to improve efficiency and reduce cost in several industries such as the food and pharmaceutical industry, forest industry, automotive, renewable energy, oil and gas as well as mining and agriculture. DT provides off-the-shelf detector products for X-ray quality assurance, sorting and non-destructive testing applications. Products range from detector cards to complete detector systems. In 2014, the security and industrial business represents approximately 62% of DT’s total net sales.

In 2014, DT’s net sales totalled EUR 33 million and the operating profit margin was 9% (the comparable operating profit margin being 12%). The Company has approximately 280 employees. The Company operates from offices and production facilities in Espoo, Oulu, Beijing, Hong Kong and in the Boston area.

[1] Local network charge/ mobile call charge