This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping us to understand which sections of the website you find most interesting and useful.

Stabilization of Detection Technology Plc share and the use of over-allotment option

DETECTION TECHNOLOGY PLC COMPANY RELEASE 15 APRIL 2015 AT 08.30 EET

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, CANADA, AUSTRALIA, HONG KONG, SOUTH AFRICA, SINGAPORE OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL.

Stabilization of Detection Technology Plc share and the use of over-allotment option

Nordea Bank Finland Plc, the Lead Manager and bookrunner in the Detection Technology Plc (“Detection Technology” or the “Company”) offering, has carried out stabilization measures with Detection Technology’s share. The stabilization started on 18 March 2015 and ended on 19 March 2015.

The stabilization was carried out in the following price range:

18 March 2015 4.90-4.95 euro

19 March 2015 4.90 euro

Nordea Bank Finland Plc will not carry out any further stabilization measures and the stabilization period has now ended.

Nordea Bank Finland Plc has decided to use its over-allotment option described in the listing prospectus and purchases 340,536 Detection Technology shares from Oy G.W.Sohlberg Ab in connection with returning to Oy G.W.Sohlberg Ab certain shares borrowed by Nordea Bank Finland Plc as part of the offering.

As a result of the exercise of the over-allotment option, the ownership of Oy G.W.Sohlberg Ab is 5,205,167 shares (40.2%). Oy G.W.Sohlberg Ab has sold 1,582,448 Detection Technology Oyj shares in total in the offering.

Nordea Bank Finland Plc serves as the Company’s certified advisor under the First North rules.

DETECTION TECHNOLOGY PLC

For further information:

| Hannu Martola, President and CEO | |

| +358 500 449475 | |

| hannu.martola@nulldeetee.com |

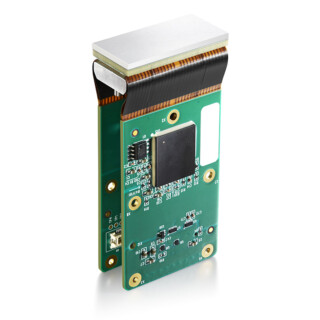

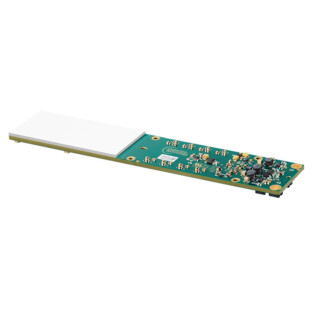

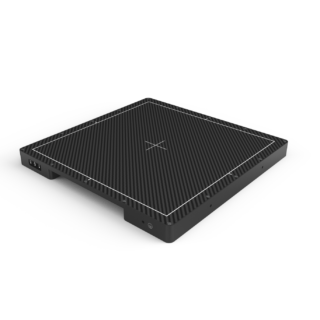

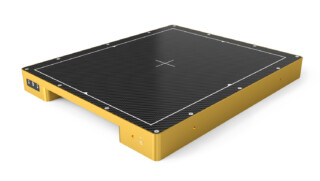

Detection Technology in brief

Detection Technology develops, produces, markets and sells components and systems for X-ray imaging solutions for medical, security and industrial applications. The Company operates from Espoo, Oulu, Beijing, Hong Kong and Boston. In 2014, Detection Technology’s net sales totaled EUR 33 million and the comparable operating profit margin was 12% (the reported operating profit margin being 9%). The company’s shares are listed on the Nasdaq First North Finland market place.

DISTRIBUTION:

NASDAQ OMX Helsinki

Key media

www.deetee.com

DISCLAIMER:

The information contained herein is not for publication or distribution, directly or indirectly, in or into the United States, Canada, Australia, Hong Kong, South Africa, Singapore or Japan.

These written materials do not constitute an offer of securities for sale in the United States, nor may the securities be offered or sold in the United States absent registration or an exemption from registration as provided in the U.S. Securities Act of 1933, as amended, and the rules and regulations thereunder. Detection Technology Plc. (the “Company”) does not intend to register any portion of the offering in the United States or to conduct a public offering of securities in the United States.

The issue, exercise and/or sale of securities in the initial public offering are subject to specific legal or regulatory restrictions in certain jurisdictions. Neither the Company nor Nordea Bank Finland Plc assume any responsibility in the event there is a violation by any person of such restrictions.

The information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of the securities referred to herein in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any such jurisdiction. Investors must neither accept any offer for, nor acquire, any securities to which this document refers, unless they do so on the basis of the information contained in the applicable prospectus published or offering circular distributed by the Company.

The Company has not authorized any offer to the public of securities in any Member State of the European Economic Area other than Finland. With respect to each Member State of the European Economic Area other than Finland and which has implemented the Prospectus Directive (each, a “Relevant Member State”), no action has been undertaken or will be undertaken to make an offer to the public of securities requiring publication of a prospectus in any Relevant Member State. As a result, the securities may only be offered in Relevant Member States (a) to any legal entity which is a qualified investor as defined in the Prospectus Directive; or (b) in any other circumstances falling within Article 3(2) of the Prospectus Directive. For the purposes of this paragraph, the expression an “offer of securities to the public” means the communication in any form and by any means of sufficient information on the terms of the offer and the securities to be offered so as to enable an investor to decide to exercise, purchase or subscribe the securities, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State and the expression “Prospectus Directive” means Directive 2003/71/EC (and amendments thereto, including the 2010 PD Amending Directive, to the extent implemented in the Relevant Member State), and includes any relevant implementing measure in the Relevant Member State and the expression “2010 PD Amending Directive” means Directive 2010/73/EU.

This communication does not constitute an offer of the securities referred to herein to the public in the United Kingdom. No prospectus has been or will be approved in the United Kingdom in respect of the securities referred to herein. This communication is directed only at (i) persons who are outside the United Kingdom or (ii) persons who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) and (iii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2) of the Order (all such persons together being referred to as “relevant persons”). Any investment activity to which this communication relates will only be available to and will only be engaged with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.